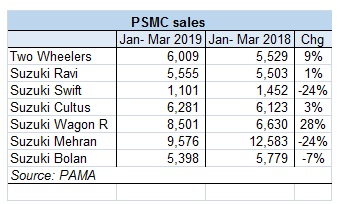

Not all is well in the house of Suzuki (PSX: PSMC), which in its quarter ending March 2019 incurred a loss per share of Rs11.92, after witnessing a loss in the fourth quarter of CY18 as well. The company’s sales units fell by 3 percent during the quarter, compared to the same quarter last year mainly due to a drop in sales for Mehran, Bolan and Swift as Wagon-R and Cultus sales continue to show strength in the face of immense market slowdown. For folks complaining about the continuous price hikes, it seems the price increases were not enough for the company to maintain any net profit margin. Gross margins fell to a phenomenal low of 3 percent.

The company, not unlike the other two players has been raising prices of different variants since Dec-17 when the rupee first started to take a nosedive, albeit less radically than its peers. Suzuki Swift which isn’t a huge customer favourite saw its prices go up by 9 percent (compare that to an increase between 18-21 percent for other cars in the market) between Jan-18 and Oct-18. The company raised no prices after Oct-18 even as Honda and Toyota raised prices in Jan and subsequently in March after the government’s move to impose FED on 1700cc and above cars. To be fair, the Jan price increase was a phased increase that both Toyota and Honda announced two months in advance.

Despite recent government actions that would have had positive implications for Suzuki—removal of ban on non-filers to buy cars, and increased restrictions on used cars—the company could not grow volumes enough. The fact that the company phased out its most localized and best-selling vehicle Mehran also meant the volume-driver drove sales downward. Moreover, cars with less localization such as Cultus and Wagon-R have been more popular amongst consumers, while there has been a clear lack of demand in the pickups and vans category. Businesses are contracting and tightening their purse strings which do not bode well for light commercial vehicles.

Revenue per unit for Suzuki on average went up by 12 percent during the period due to the price increases but was nearly not enough. Since the company depends on completely knocked down (CKD) kits to assemble vehicles, and auto parts manufacturers need imported inputs, auto makers have had a tough time with rupee devaluation. Since Jan-18 (till Mar-19), the rupee has depreciated by 27 percent pointing towards more expensive imports. As a result, it has a nearly 60 percent reduction in gross profits.

Though indirect expenses remained constant at 4 percent of revenues, the company’s borrowing costs have ballooned not only because of the higher rate banks are charging now after multiple sessions of monetary policy tightening but also because of increased short term borrowing to manage cash flows.

Advances have diminished. They will continue to dwindle down even as Alto bookings have started. The company needs to announce the actual prices for Alto variants so consumers can make informed decisions. Fuelling uncertainty in an uncertain market is not great for Suzuki’s volumes either. CY19 will be a tough year.

Comments

Comments are closed.