KSE-100 plunges over 450 points amid uncertainty on upcoming budget

- Experts say market remains anxious regarding proposals to be announced in the budget tomorrow

Apprehensions pertaining to the upcoming budget FY23-24 pushed the Pakistan Stock Exchange (PSX) into the red zone, as the benchmark KSE-100 Index lost over 450 points on Thursday.

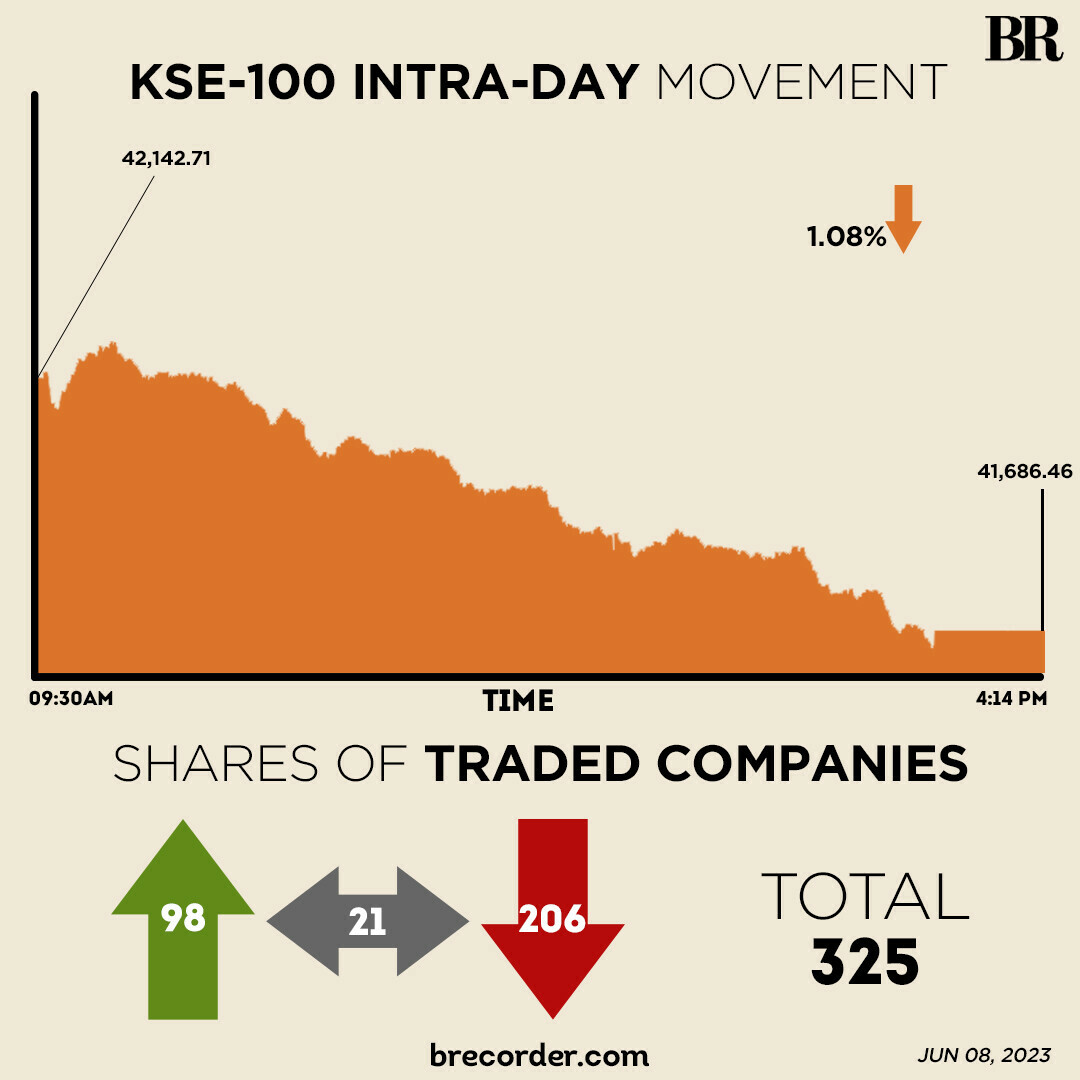

At close, the KSE-100 Index was at 41,686.46, a decline of 456.25 points or 1.08%.

Across-the-board selling pressure was witnessed with index-heavy sectors including, commercial banks, automobile assemblers, cement, chemicals, fertilisers, oil & gas exploration companies and OMCs trading in the red.

Experts were of the view that the market remains anxious regarding proposals in the upcoming budget, which is scheduled to be announced on Friday.

“Concerns pertaining to budget FY23-24 are driving this negative sentiment at the bourse,” Fahad Rauf, Head of Research at Ismail Iqbal Securities Limited, told Business Recorder.

“There are concerns that additional taxes could be imposed on listed companies including banks,” he said.

KSE-100 rises for fourth successive session, index up 0.52%

Pakistani authorities are set to present the federal budget for fiscal year 2023-24 on Friday. Finance Minister Ishaq Dar will be seen juggling between keeping the IMF onboard for a teetering bailout programme Pakistan so desperately needs, and pacifying the public that is dealing with the repercussions of an economic fallout through record inflation.

Rauf said that there are also concerns that the government could give a populist budget, in its bid to woo voters. “If this happens, this could dent the International Monetary Fund (IMF) programme,” he said.

There will be no winners, say experts ahead of budget announcement

Esther Perez Ruiz, IMF resident representative for Pakistan, said on Thursday that the country has to satisfy the lender on three counts, starting with a budget to be presented on Friday before its board will review whether to release at least some of the $2.5 billion still to be disbursed under a lending programme that will expire at the end of this month.

A report from Capital Stake highlighted that negative sentiments surrounded the Pakistan Stock Exchange (PSX) on Thursday.

“Investors preferred to stay on the sidelines ahead of the announcement of economic survey and budget,” the research house said.

Sectors pulling the benchmark KSE-100 Index downwards included banking (128.74 points), technology and communication (84.30 points) and oil and gas exploration (83.13 points).

Volume on the all-share index decreased to 203.8 million from 332.5 million on Wednesday, while the value of shares traded declined to Rs5.8 billion from Rs7.1 billion recorded in the previous session.

Unity Foods Limited was the volume leader with 28.7 million shares followed by WorldCall Telecom with 17.6 million shares and TPL Properties with 15.8 million shares.

Shares of 325 companies were traded on Thursday, of which 98 registered an increase, 206 recorded a fall and 21 remained unchanged.

Comments

Comments are closed.