While its share in comparison to crude oil and natural gas remains miniscule at 1.3 percent, Liquefied Petroleum Gas (LPG) production and consumption has seen significant growth over the last 4-5 years. The poor man’s fuel is becoming a key fuel for domestic heating where there is unavailability of piped gas as well as in the transport, commercial and industrial sector.

However, over the past few months the local players and LPG distribution companies have been complaining about the lack of level playing field. As soon as it came to power, the present government had shown the intent to deregulate LPG prices. While that has remained in limbo, complaints have risen on the lack of policy action against a number of challenges that restrict fair play.

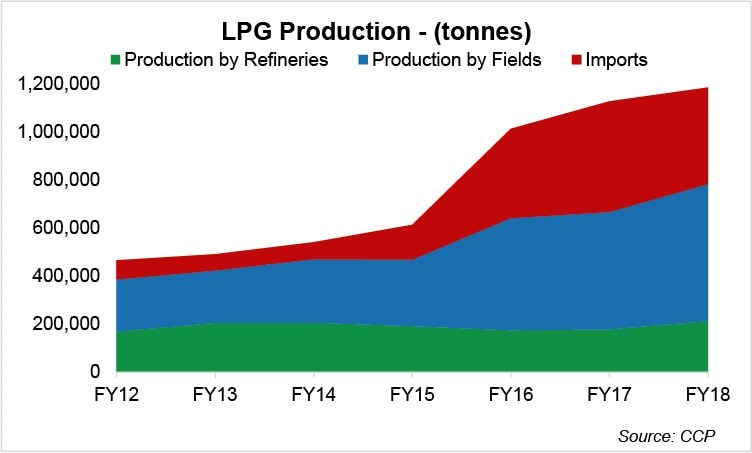

For one, the government has been blamed for indirectly supporting the importers of LPG over local production. During FY18, the total LPG supplies stood around 1.19 million tons, while the LPG consumption was about 1.28 million tons, which is met through imports. Local production comes from the oil refineries and gas fields held by the E&P companies, and the imports constitute LPG via sea and land route both.

The challenge that the industry faces is that where the local LPG prices are regulated, import of LPG falls under deregulated purview. Sales tax on indigenous LPG is 17 percent while that on imported LPG is 10 percent. Further, where local LPG is subject to Petroleum Development Levy/regulatory duty of Rs4669 per ton, LPG imports are exempt from regulatory duty. This was also highlighted by Iqbal Z. Ahmed – CEO Associated Group in his latest interview with Business Recorder (For more read: Govt. favoring imported LPG over local production).

Other barriers to level playing field in the LPG sector also highlighted by Competition Commission in its recent study on LPG sector include substandard LPG import through land route especially the Taftan border, under invoicing, use of hundi and hawala system in LPG import through land route, no LPG quality testing lab for land imports etc.

A recent blow to local production comes from the expiration of the contract between SSGC and JJVL, which has wiped out 300 tons per day of LPG from the system – that accounted for around 15 percent of the total market.

Does this mean that another crisis is brewing? if things remain as they are, the coming winter season will bear the brunt when the daily demand for LPG rises by 1000 tons per day from 2500 to 3500 tons per day. The government however reportedly has shown interest in removing impediments to uninterrupted supply and anomalies in pricing in its long term policy for LPG. Fingers crossed!

Comments

Comments are closed.