So far as key indicators are concerned, the year 2020 has apparently ended on a good note for the country’s microfinance sector. At least that’s what is reflected in the Oct-Dec 2020 data released recently by Pakistan Microfinance Network (PMN), the representative body of microfinance providers (MFPs). The middle quarters of the year were blighted by Covid-related health-cum-economic crisis that affected lives and livelihoods, especially of those at the bottom of pyramid.

By December 2020 close, the number of active borrowers had reached 7 million, a decline of 3 percent over December 2019 level. The gradual growth was disrupted during the economic troubles in the middle of 2020, as demand for fresh credit was affected by downcast business prospects and the supply of fresh credit was impacted by lower lending appetite among MFPs amid losses all around.

There is some recovery in active borrowers towards the end of 2020 – let’s see if this is carried forward into 2021 to reach target of 8 million borrowers. The sector’s gross loan portfolio, or outstanding credit, saw a 6 percent yearly growth in 2020, however. The credit uptick in the Oct-Dec quarter is the fastest in a quarter for almost two years. On this count, the sector is now well ahead of pre-pandemic level.

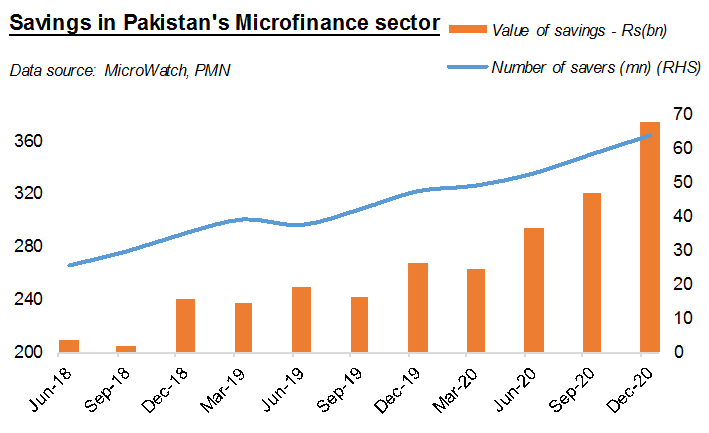

The savings department continues to amaze, something which wasn't disturbed by the pandemic. By 2020 end, the three dozen or so MFPs had collectively raised Rs374 billion in deposits, a strong growth of 40 percent year-on-year. In the Oct-Dec quarter alone, a record ~Rs53 billion in additional savings were raised. This cheap financing source is of great help for MFPs to fund their portfolios.

Meanwhile, the number of savers had reached 64 million in 2020, a solid growth of 35 percent over previous year. Most of this growth is explained by the rising uptake of mobile wallets in the branchless banking domain. As the PMN notes, over 80 percent of active savers come from m-wallets; but over 80 percent of value of savings comes from traditional savings accounts maintained at branches.

It appears that the sector has entered 2021 with a nice tailwind. But it remains to be seen how the pandemic-related loan deferments/restructuring will impact bad debts in coming months. Besides, non-banking microfinance companies (which cannot raise deposits) may not be doing as well as microfinance banks (which can raise deposits and have access to central bank financing support). A better picture needs to emerge as to how the likes of rural support programs and grassroots organizations are doing.

Comments

Comments are closed.