Lower production in 2QFY21 both year-on-year as well as sequentially as well as currency appreciation have been named key factors for declining profitability of the listed exploration and production sector. While OGDCL and PPL are yet to announce their financial result for 2QFY21, POL’s earnings declined due weaker production flows.

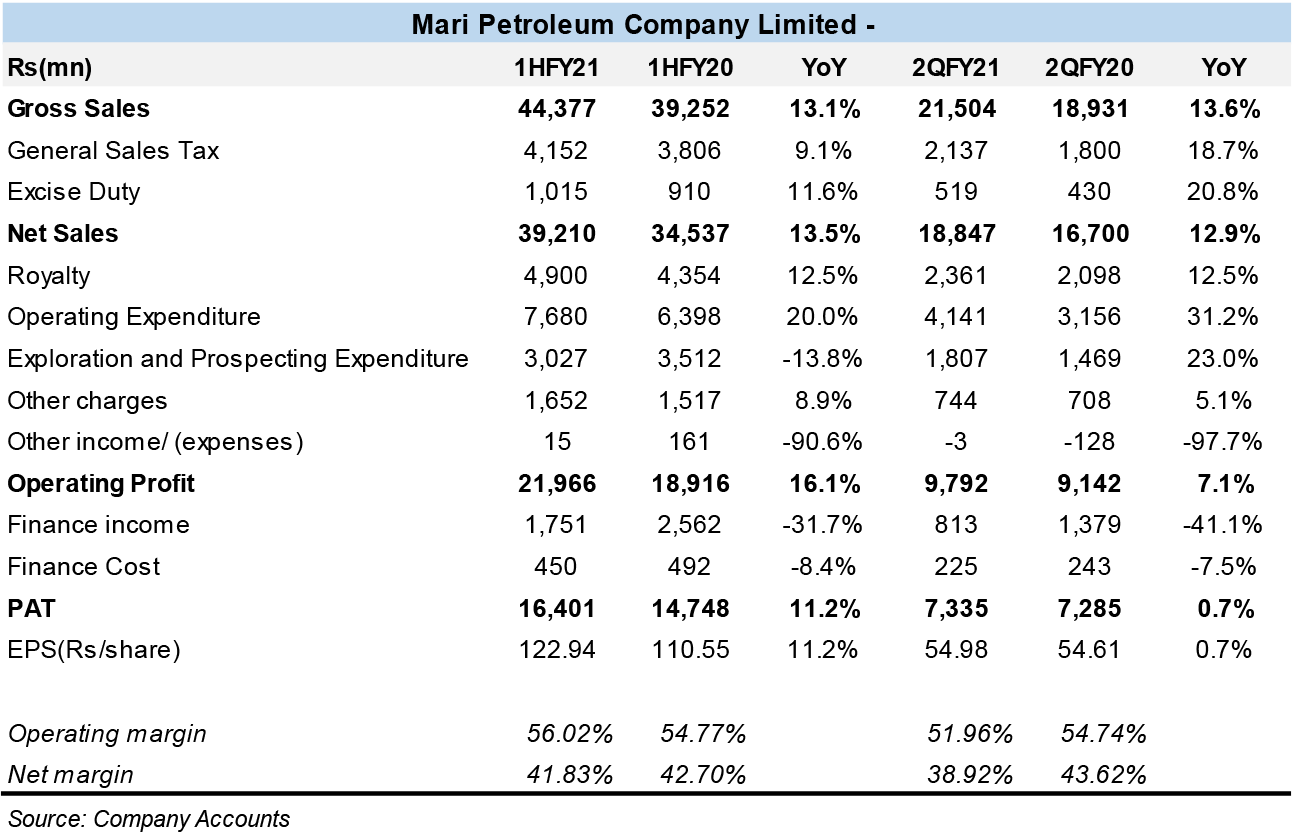

On the other hand, Mari Petroleum Company Limited (PSX: MARI) announced its performance just recently and the company’s earnings for 2QFY21 remained flat year-on-year, resulting in 11 percent year-on-year profits for 1HFY21. Compared to others, MARI’s performance was expected to be better due to increase in gas production. Quarter-on-quarter, the company’s gas production declined and hence revenues declined too; however, year-on-year, Mari’s gas production for 2QFY21 is expected to have increased by 13 percent along with over 25 percent rise in oil flows. And despite over 30 percent decline in prices, topline witnessed a growth of 13 percent in 2QFY21. In 1QFY21, gas production from Mari field grew by 5.5 percent year-on-year; Overall, 1HFY21 net revenues moved up by 13.5 percent.

On the expenditure side, MARI’s exploration and prospecting expenses escalated by 23 percent in 2QFY21, year-on-year. this was because of higher exploration activity in the quarter after slow 4QFY20 and 1QFY21 in terms of drilling and prospecting. Higher E&P expenses are likely to be the trend in the coming quarters as well as the company has recently been awarded 4 new exploratory blocks.

The E&P company announced its first interim cash dividend of Rs6 per share. the divestment of governemnt shareholding from MARI has been delayed for a long time. While there are still many approvals to go, the process has moved a step ahead with the governemnt removing MARI’s dividend cap; the removal of restriction of the company’s dividend would help fetch a better price for government’s 18.39 percent shares.

Comments

Comments are closed.