Things seem to be moving in the power sector. Another thing if it is only about tariffs, adjustments and revenues. Another month and another request for quarterly tariff adjustment awaits the regulator’s hearing and subsequent decision. Recall that the previous quarterly tariff adjustment was only announced last month, right after the base tariff upward revision.

Make no mistake, this is not criticism. In fact, timely adjustments should be welcome. The backlog of quarterly adjustments had become a massive problem, as the previous government shied away from timely adjustments. Not that the consumers do not eventually have to pay, it is just that it adds to the already clogged circular debt pipeline, and that means more payments in lieu of interest for the debt parked aside.

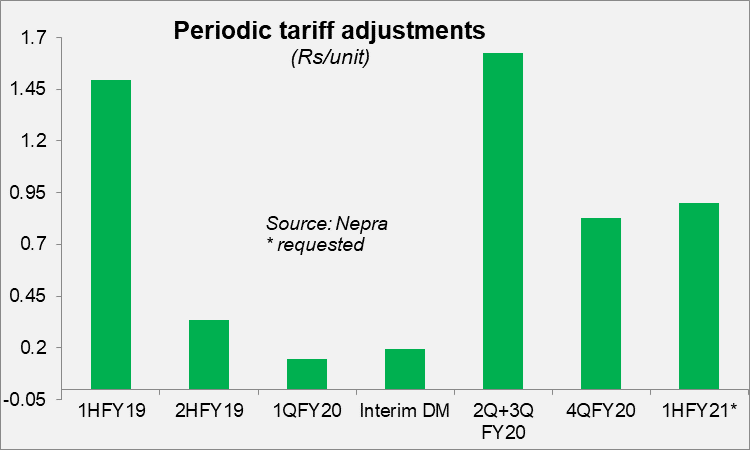

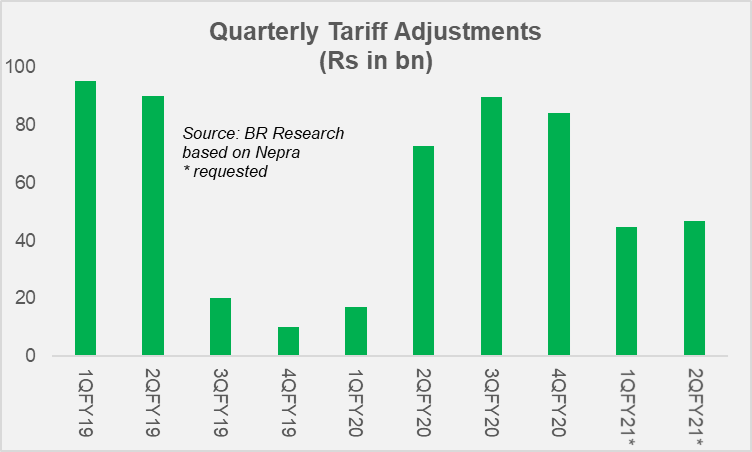

Back to the numbers. The adjustments requested by the 10 power distribution companies for 1QFY21 and 2QFY21 amount to Rs91 billion. If previous quarterly adjustments are a guide, the allowance by the regulator has not deviated a great deal from the requested amount. Based on the energy purchase pattern used for previous adjustments that pertained to the FY18 determined tariff, the adjustment comes down to Rs0.9 per unit.

Not that 90 paisas per unit charged over 12 months ad adjustment is not significant, but it pales in comparison to the most recent quarterly adjustments which were almost double the one sought for 1HFY21. No marks for guessing that the bulk of adjustment pertains to the capacity purchase price at Rs70 billion, or 77 percent of the amount sought. That said, this is significantly lower than 97 and 88 percent of capacity component in the previous two half yearly quarterly adjustments.

Now that all adjustments to this point have been made, and the new base tariff is also in effect, it is highly likely that the upcoming quarterly adjustments for the next two to three quarters, would be on the lower side.

But the consumers are in for a long tough ride. Recall that the 2Q and 3Q adjustments of FY20 amounting to Rs1.62/unit was announced with effect from November 2020. Then came the 4Q FY20 adjustment announced in February with another Rs0.83/unit. And now there is the 1HFY21 adjustment which could be close to Rs0.9/unit.

Add these up, and for the best part of the next 12 months, consumers will be paying Rs3.35 per unit in tariff adjustments alone. Rs 1.8/unit of quarterly adjustments had lapsed in October 2020 – that still leaves with Rs1.5/unit additional burden. The base tariff upward revision of Rs1.95/unit is in addition to this. And the almost compulsory upward revision in monthly FCA to the tune of Re1/unit adds to the misery. Not that any of it is uncalled for, but it will sure have inflationary consequences.

How many of the quarterly revisions have already been notified remains a mystery, which reminds one that an organization as well-staffed as Nepra should do well to update the “Applicable Tariff” tab on its website, which otherwise gets routinely updated.

Comments

Comments are closed.