Finally, a moment of sigh. The upward streak of monthly inflation is broken. In Dec20, the inflation was down by 0.68 percent from Nov20 – first time it’s negative since Apr20. On yearly basis, the headline inflation stood at 8 percent. The six months (Jul-Dec) average inflation stood at 8.7 percent. A slightly higher number is expected in the second half to make the full year inflation around 8.8-9.0 percent –making real negative interest rates at 2 percent – this is in line with global monetary policy responses in days of COVID.

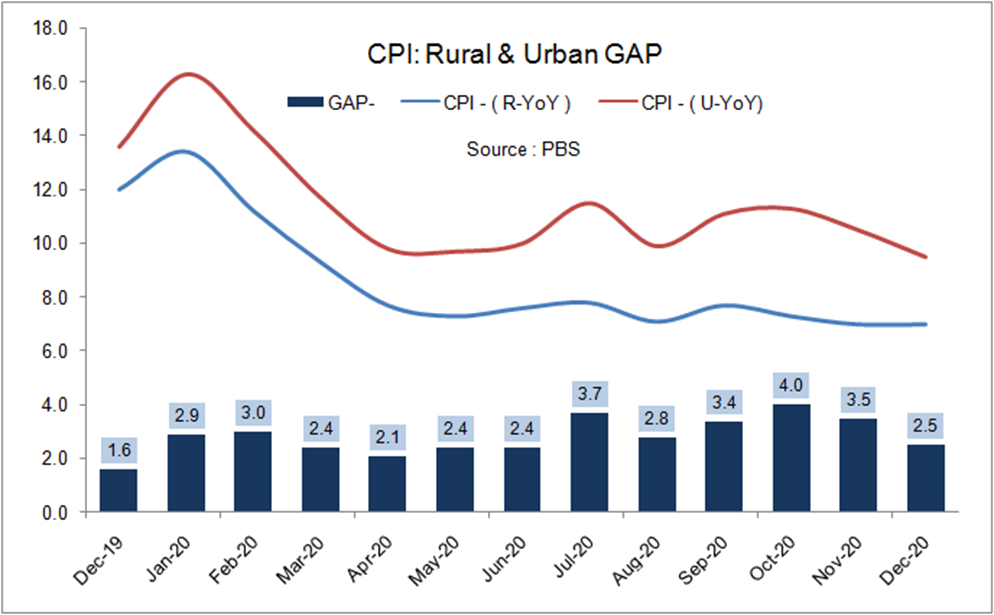

The food inflation is finally cooling down. Earlier food prices were keeping the CPI high and the food prices increase was higher in rural segments as compared to urban. Not only the food prices moved higher in rural areas, the weight within CPI is higher for rural. That was increasing the divide between the rural urban inflation –the gap reached at 4 percent (urban 7.3% and rural 11.3%) in October and now it has thinned to 2.5 percent – the rural inflation on MoM basis declined by 1.2 percent versus urban at 0.3 percent. In case of food, rural MoM inflation is down by 3.4 percent as compared to urban at 2.1 percent.

The decline in food items prices is taming the SPI computed on weekly basis. Here the weight of food is even higher. The SPI is down to 6.1 percent for the week ending 31st December. The number was 9.7 percent two months back and was 15 percent plus earlier in 2020.

The decline in food items prices is in both non-perishable (-0.2% MoM) and perishable items (-1.0% MoM). The supply chain is improving and that is bringing the prices down be it onion, tomatoes, vegetables, sugar or wheat. However, the prices of eggs, spices, butter, and ghee are moving up. Although the global food price index is heading north, Pakistan food prices are moving down – as prices at home in case of wheat and sugar went up higher than international prices. Now these are normalizing. The global indices are expected to normalize in the next 6 months. The problem at home could be of ghee prices as the impact of increase in global palm oil prices are yet to fully pass on.

Now with ease in food prices and high base effect of Jan20, the CPI in Jan 21 will come down further. Now it’s the time to pass on the long awaited electricity prices increase. The base tariff is expected to increase by Rs3.3-3.5/unit in the next 3-6 months. Some of this will be pass on in January. Already in December, the fuel cost monthly adjustment in electricity is pulling CPI up. The electricity prices will keep the inflation under pressure.

International oil prices are moving up and that is exerting the pressure on domestic petrol and diesel prices. But the government is not fully passing on the impact by lowering the taxes. With IMF coming back, there will be pressure on revenues and sooner or later government has to increase the fuel prices. The only savings could be in the case of decline in international oil prices, which seems unlikely as of now.

With the base effect and the increase in base tariff and other factors, inflation may come to double digits in April and would peak in May before June-Oct high base effect comes into the play to lower the CPI. Nonetheless, negative real interest rates of 2 percent would put some pressure on the monetary policy committee to marginally increase the interest rates, once IMF programme is back in action. Earliest this could happen in May 21.

Comments

Comments are closed.