Pakistan’s plastics exports have seen their fortune decline since their peak in 2011 when they crossed the half a billion dollars’ mark. Though exports of almost all plastic products have declined, it is Polyethylene Terephthalate (PET) that raises the most flags.

Pakistan’s main plastic export is PET to EU, USA, and Turkey. The first blow came from the EU when a countervailing duty rate of 5.1 percent was imposed on Pakistan’s PET exports in 2010. The second blow came from Turkey when Ankara increased the safeguard duty from 3 percent to 8 percent. The third and most recent blow comes from the US, which last month began an investigation regarding whether PET imports from Pakistan, among other countries, are causing injury to US producers.

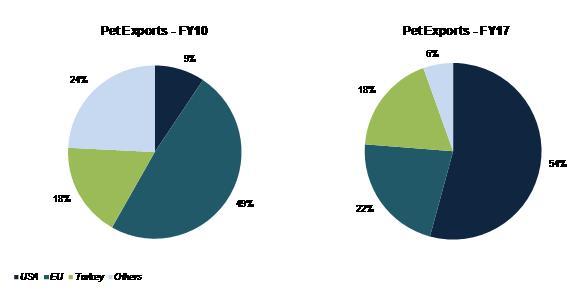

Since 2010, Pakistan’s PET exports have nearly halved from $218 million to $111 million. The biggest decline came from exports to EU that fell to $25 million in FY17 from $107 million. The EU ruling expired in 2015 after which Pakistan took the case to the WTO dispute settlement system, which ruled in Pakistan’s favour earlier this year. Since then, Pakistan’s exports to EU have not shown any sign of recovery; exports to EU in July and August of this year were 18 percent less than the same period last year.

However, the decline in exports to EU had been somewhat compensated by increase in PET exports to the US. Since 2010, Pakistan’s exports have tripled from $20.5 million to $60 million. However, if US rules against Pakistan, PET exporters will lose their largest market currently. A decision is expected to be announced in March. However, the impact is unlikely to be felt before fall 2018 which is when the US is expected to complete its investigative process and determine final dumping duty.

Though there is little Pakistan can do currently to prevent US from ruling against its PET exports, it can work towards resuming its exports to the EU. Furthermore, PET should be among the list of commodities that are being negotiated under the FTA with Turkey. Failing to utilize these avenues may mean that Pakistan loses out on its top plastic export.

Comments

Comments are closed.