KSE-100 ends flat as market awaits budget 2022-23

- Investors wait in vain for the budget announcement before making equity investment decisions

The Pakistan Stock Exchange (PSX) remained volatile on Wednesday and ended flat as investors waited ahead of the federal budget announcement before making equity investment decisions. This was the second successive flat closing for the KSE-100 as participants continued to stay on the sidelines. In addition, a stalemate over resumption of the IMF programme also dampened investor sentiment.

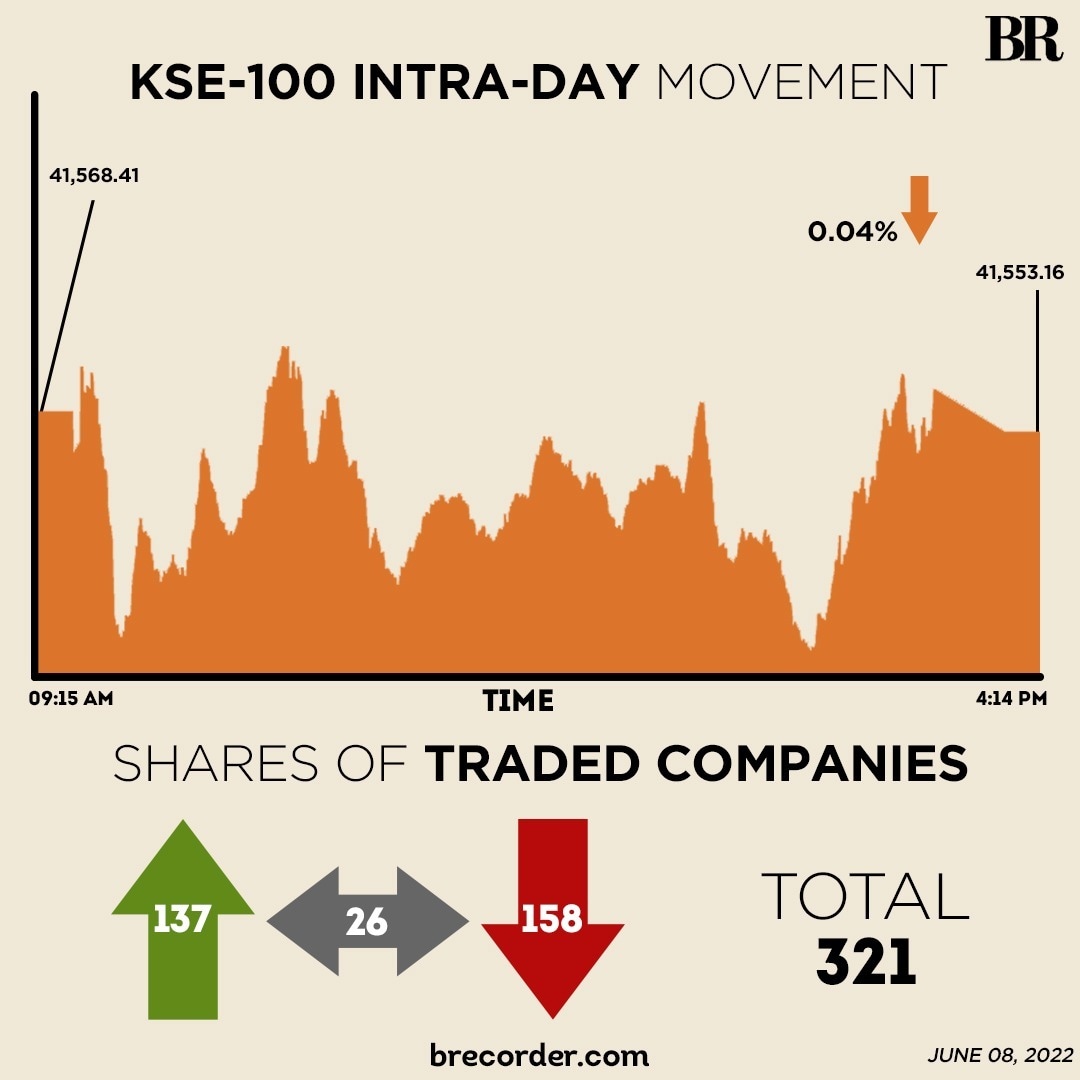

At close, the index ended up at 41,553.16, a decline of 15.25 points or 0.04%.

KSE-100 Index ends flat amid low volume

Range-bound activity was witnessed at PSX where the benchmark index hit an intra-day high of 41,620 and a low of 41,392.

A volatile session was witnessed as investors opted to remain on the sidelines as lackluster volume was witnessed in the main board stocks whereas hefty volumes were observed in 3rd-tier stocks, said Arif Habib Limited (AHL) in its post-market comment.

“The PSX continued to remain under pressure throughout the day due to concerns regarding adverse upcoming budget and mounting inflation,” said AHL. “Banking sector stayed in the red zone due to expectation of higher super tax and increase in other taxes in the upcoming budget,” it added.

On the economic front, domestic cement sales fell by 1.56% on YoY basis while exports fell by 76.97% from the same period last year, shared All Pakistan Cement Manufacturers Association. On a MoM basis, domestic cement sales declined by 6.52% while exports were up by 9.55%.

Sectors pushing the benchmark KSE 100 index lower included banking (62.88 points), fertilizer (18.24 points) and textile composite (15.67 points).

After record low, rupee gains against US dollar in inter-bank market

Volume on the all-share index dropped to 151.1 million from 157.4 million on Tuesday. The value of shares traded, however, increased to Rs4.5 billion from Rs4.2 billion recorded in the previous session.

Unity Foods Limited was the volume leader with 11.83 million shares, followed by D.G.K. Cement with 9.62 million shares, and Oilboy Energy(R) with 8.26 million shares.

Shares of 321 companies were traded on Wednesday, of which 137 registered an increase, 158 recorded a fall, and 26 remained unchanged.

Comments

Comments are closed.