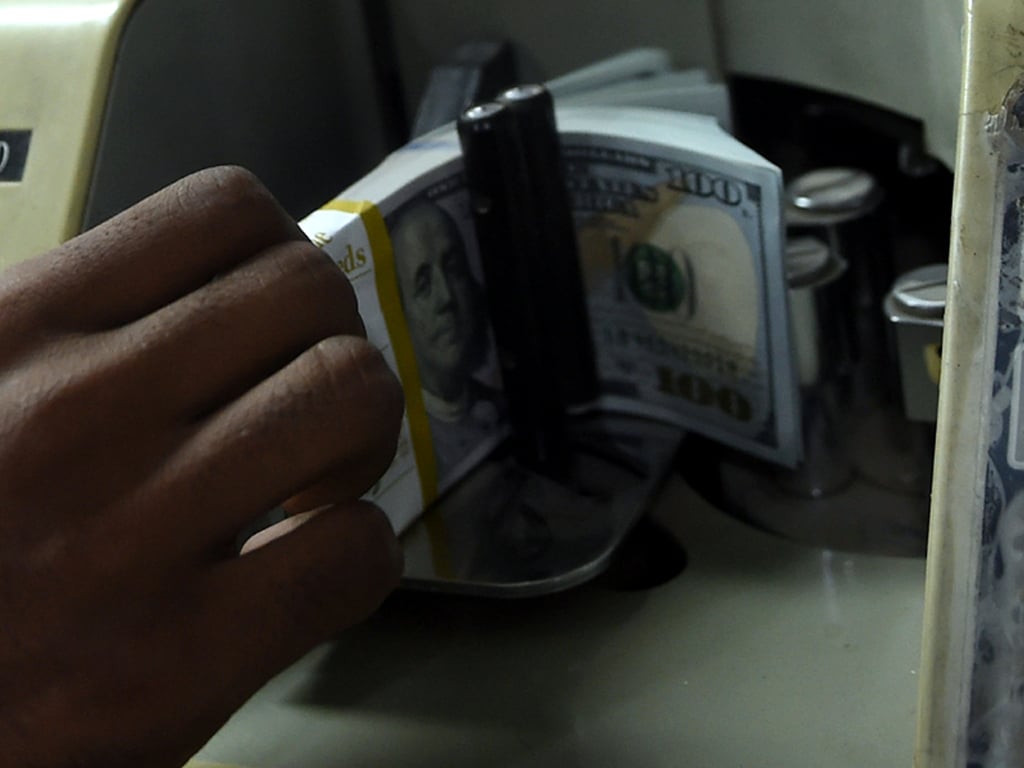

Rupee continues to appreciate for 5th successive session, closes at 170.54

- Has now cumulatively gained Rs4.73 in one week

Pakistan's rupee continued to appreciate against the US dollar, strengthening for the fifth successive session to close at 170.54 in the inter-bank market on Tuesday.

As per the State Bank of Pakistan (SBP), the PKR settled at 170.54 against the USD after a day-on-day appreciation of Rs0.75 or 0.44%. On Tuesday last week, the PKR had dropped to its lowest level against the US dollar, closing over the 175 level for the first time in the inter-bank market.

However, since then, the currency has recovered significantly, gaining Rs4.73 during the last five sessions.

The appreciation comes after Saudi Arabia's announced a $4.2-billion support package for Pakistan, while reports suggest that Islamabad also moved closer to finalising talks with the International Monetary Fund (IMF) that would see another billion-dollar inflow.

Last week, the Saudi Fund for Development (SFD) announced the issuance of the Royal Directive to deposit an amount worth of $3 billion into the central bank of Pakistan. Additionally, the SFD said that the royal directive was also issued to finance the oil derivatives trade with a total amount of $1.2 billion throughout the year.

Fourth successive gain: Pakistan's rupee closes at 171.29 against US dollar

While the inflow could help cool off the currency market that has seen the rupee under substantial pressure since May this year, more worrying for Pakistan's policymakers would be the burgeoning trade and current account deficits.

With inflation already hitting a four-month high at 9.2% in October, trade deficit figures also reported a sharp increase year-on-year.

The trade deficit, gap between exports and imports, rose 104% to $15.525 billion during the first four months (July-October) of 2021-22, up from $7.617 billion in the corresponding period of financial year 2020-21.

This has also raised concerns of an increase in USD demand in coming days, which could hurt the PKR. With commodity prices on the rise, many believe inflationary pressure would continue to build, while putting the currency under strain as well.

Inter-bank market rates for dollar on Tuesday

BID Rs 170.10

OFFER Rs 170.20

Open-market movement

In the open market, the PKR gained 70 paisas for both buying and selling against USD, closing at 170.50 and 171.50, respectively.

Against Euro, the PKR remained unchanged for buying while gaining 40 paisas for selling, closing at 196.50 and 198, respectively, reducing the spread.

Against UAE Dirham, the PKR gained 60 paisas for both buying and selling, closing at 47.50 and 47.90, respectively.

Against Saudi Riyal, the PKR gained 10 paisas for buying and 15 paisas for selling, closing at 45 and 45.40, respectively.

Open-market rates for dollar on Tuesday

BID Rs 170.50

OFFER Rs 171.50

Comments

Comments are closed.