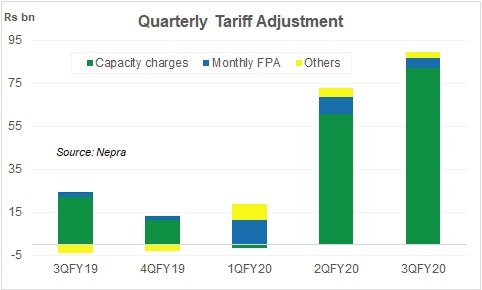

Power distribution companies (discos) have filed their respective cases for quarterly tariff adjustments for second and third quarters of FY20. The tariff requested to be adjusted for 2QFY20 and 3QFY20 combined amounts to a little over Rs160 billion. For a consumption of 60 billion units in half year – this equals Rs2.66/unit upwards adjustment in lieu of two quarterly adjustments.

The news channels can relax. These are only requests and are not going to be entertained in a hurry, if at all. Recall that Pakistan is currently undergoing a phase of price freeze for power and gas. And this way well before Covid had made inroads in the country. So, the power tariffs are under no real threat of a massive upwards revision – not just yet.

Combined for three quarters in FY20 – the upward adjustment totals Rs180 billion, as 1QFY20 adjustment was a relatively smaller one. Of the Rs17 billion adjustment requested, discos were granted Rs15 billion. But that never became part of the tariffs, as the Prime Minister had soon after called for all energy tariffs to be frozen until further orders. Back then, inflation had touched multiyear high.

The upward adjustment for 2Q and 3Q almost entirely relates to capacity charges, with an 88 percent share in the requested tariff adjustment. Some discos have not included the impact of the impact of T&D losses on monthly FPA – because monthly fuel price adjustment has also been on hold since November 2019. The actual number would be much higher, whenever Nepra decided to determine the long due monthly FPAs.

With power demand still struggling to rise, and the generation mix going haywire in the last two months, it would not be surprising to see the capacity payments forming another sizeable chunk of the 4QFY20 power tariff adjustment.

So much for the ‘automatic’ quarterly tariff adjustments, agreed with the IMF just last year. Not that, this has not ever happened before. The last two IMF programs saw an exact repeat of what is going on right now. After the first big round f price adjustment, the prices went into a long period of hibernation both in 2010 and 2014. The price that the system and the economy paid later, is no secret.

Granted, these are unusual times, but the decision had been taken before Covid. A backlog to the tune of Rs200 billion is promised to be added to just the tariff adjustments. Let us not even go into the payment side of circular debt chain. There is no end in sight with this policy. Unless the government is seriously working on negotiating capacity charges, the entire power system is surely on its way to another long period of drag. But don’t worry. We will settle the debt with Sukuks, every now and then.

Comments

Comments are closed.