Cement manufactuers have managed to keep suitably afloat against sufficiently stacked odds, massive thanks to prices in the domestic market. Before-tax earnings cumulatively for 12 cement companies (out of the 16 listed) rose 17 percent during 9MFY23, year on year, boosting a revenue growth of 26 percent despite total offtake dropping 18 percent. Cement prices have overshadowed and more than compensated for the demand slowdown in the construction industry and cement companies have reaped the returns.

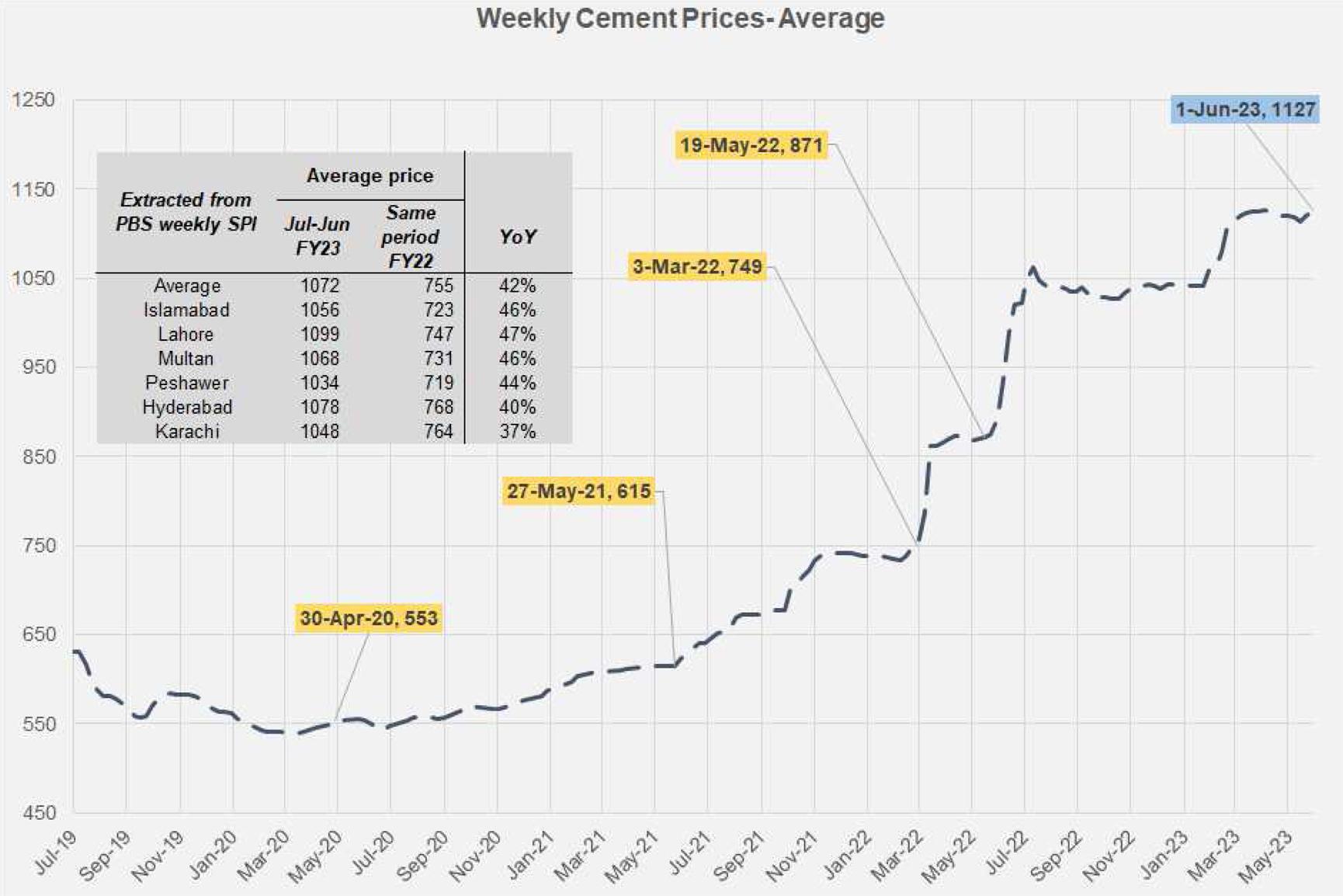

If the current trajectory is maintained, with only a few weeks till the fiscal year wraps up, cement prices as captured by the weekly price movements of the Pakistan Bureau of Statistics SPI division will have—on average—increased by upwards of 42 percent across markets compared to the average prices during the same period last year. The average retention earned for the industry is even higher. In 9MFY23, the revenue per ton sold for aforementioned cement companies rose 53 percent (as estimated by BR Research using financial statements of companies and offtake numbers extracted from the Cement Association), versus a cost per ton sold increase of 51 percent. Whatever cost inflation cement manufacturers have faced due to rising fuel prices has been passed onto consumers, and then some.

Prices for other construction materials including steel, marbles and tiles, fittings, PVC and even bricks have also kept with the general upward trajectory. Even if cement manufacturers were to lower prices to offload more cement, demand in the construction industry is limited and other construction materials have not become cheaper. Only a few months ago, builders raised a lot of hue and cry announcing a ban on steel procurement in protest of massive price hikes in rebars.

The cement industry capacity in 10MFY23 (July to May) is hovering around 57 percent and any further reduction in demand may shrink utilization even further given also that new capacities are coming online. Typically, cement companies tend to compete on prices when utilization drops as they are more eager to sell to the market and not leave large capacities lay idle. But demand is not expected to waver too much as development spending will remain suppressed and consumers’ buying power is drying up. At such a time, cement manufacturers will try to sell off as much cement they can in the domestic market—where they enjoy significant pricing power and then offload the

rest onto exporting markets if they are good for margins. Needless to say, it doesn’t serve anyone to lower prices—it certainly won’t ramp up demand—and anyway, some cement companies may not even be able to afford it given their leverage positions.

Comments

Comments are closed.