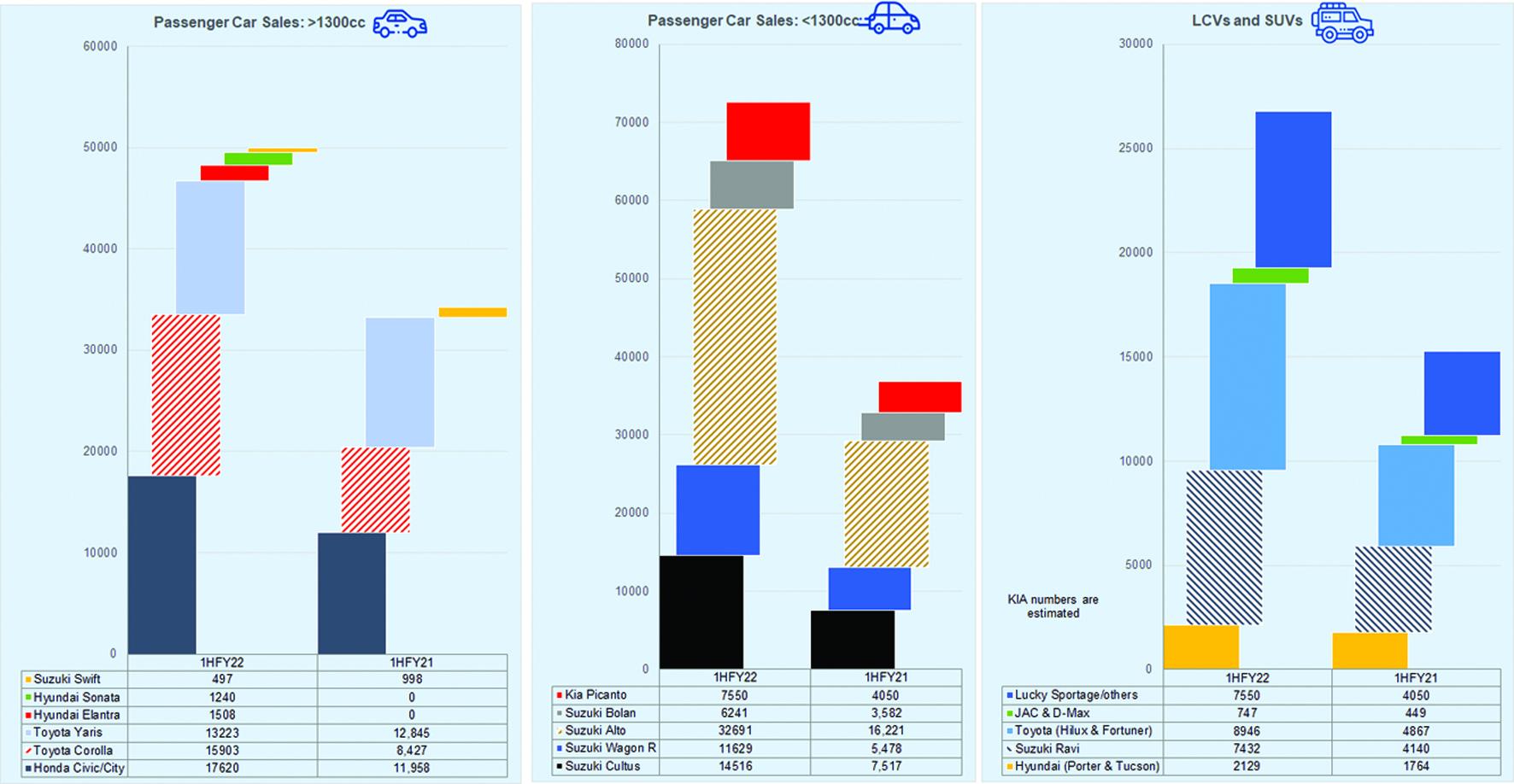

The auto industry has certainly ended the calendar year with a bang. In the cumulative first half of the fiscal year, passenger cars, LCVs and SUVs cumulatively rung in 72 percent more sales compared to 1HFY21, with sales in Dec-21 really boosting volumes. In large part, this growth can be associated to earlier price reductions (owing to government slashing duties and taxes) and fairly affordable bank financing until recently when interest rates were increased in addition to life fairly normalizing after the covid-lull. In fact, this growth is despite global semi-conductor chip shortages affecting domestic production of vehicles. Sales could have been higher, and if the current pace is maintained, auto sales could rake in some of the highest volumes in recent history. But that may not materialize after all.

More immediately, this is because cars are more expensive. Car financing is going up—nearly 40 percent of all cars are bank financing and higher interest rates should affect demand—of at least smaller cars compared to SUVs which have a fast-growing share in the market. Car prices have also increased. The dual effect of car price increases and interest rate hike would add a monthly burden of Rs5,000 to Rs10,000 on car buyers for a range of small or mid-sized vehicles. Even if this does not affect corporate buying or buyers of larger sedans and SUVs, for individual car buyers in mid-income categories, the demand would get affected. There is certainly a link between Kibor movements and car sales. Rates are expected to go further up.

But in the broader sense, the failure lies with government policies. Subsequent governments have been trying to turn Pakistan into an automotive manufacturing country but thus far have failed to achieve the desired outcomes. The market is small and it hasn’t expanded in size, despite the previous government’s policy of incentivizing new investments which did succeed to the extent of bringing more players into the mix. Now there are more assemblers than ever before but volumes are not growing as fast. This government decided to take it up a notch and offer a host of duty and tax cuts to make those volumes happen. That move monumentally failed.

There is no internal consistency in this government’s policies and a lot of the measures undertaken are quick fixes for deeper problems. For instance, suddenly announcing a reduction in taxes to boost volumes and then, increasing the same taxes to limit imports and safeguard the current account shows an inconsistency that is almost puzzling lacking any foresight; even short-term. That cars will become “affordable” because the government decides to slash duties and taxes was a rather naïve (read: ignorant) and ill-advised idea in the first place, but then, not having those reductions last even a few months is almost indefensible.

After those duties and taxes were reduced, car makers dropped prices and nearly a month later, raised prices citing rupee depreciation and higher freight rates. How could the EDB responsible for the policy not see this coming? It’s a tale as old as time—that prices are raised when manufacturing costs increase; and manufacturing costs do increase frequently as they are heavily dependent on imports which are sensitive to global commodity prices and rupee’s movement against the dollar. The solution was always to localize. But as Asif Rizvi, CEO Lucky Motors told in a recent interview with BR Research, localization has barely moved an inch and there is no policy to make that happen. What we call localization is in fact local purchase—most of the raw material that is used by auto parts makers and assemblers is imported and hence the problem persists. The oft-quoted localization figure of 50-60 percent within the auto industry, Rizvi says, is not accurate. The actual localization is no more than 18 percent.

Arbitrary duty and tax reductions have never been compelling policy tools in Pakistan even if they are the only tool available in the government’s artillery, but the real rub is when these measures are not even consistently implemented. One can simply not see past such a failure to launch. For now, the automobile industry is catering to a very small share of the population and even though volumes have grown in 1H, the full-year given recurrent unstable economic challenges may not bear the desired fruits.

Comments

Comments are closed.