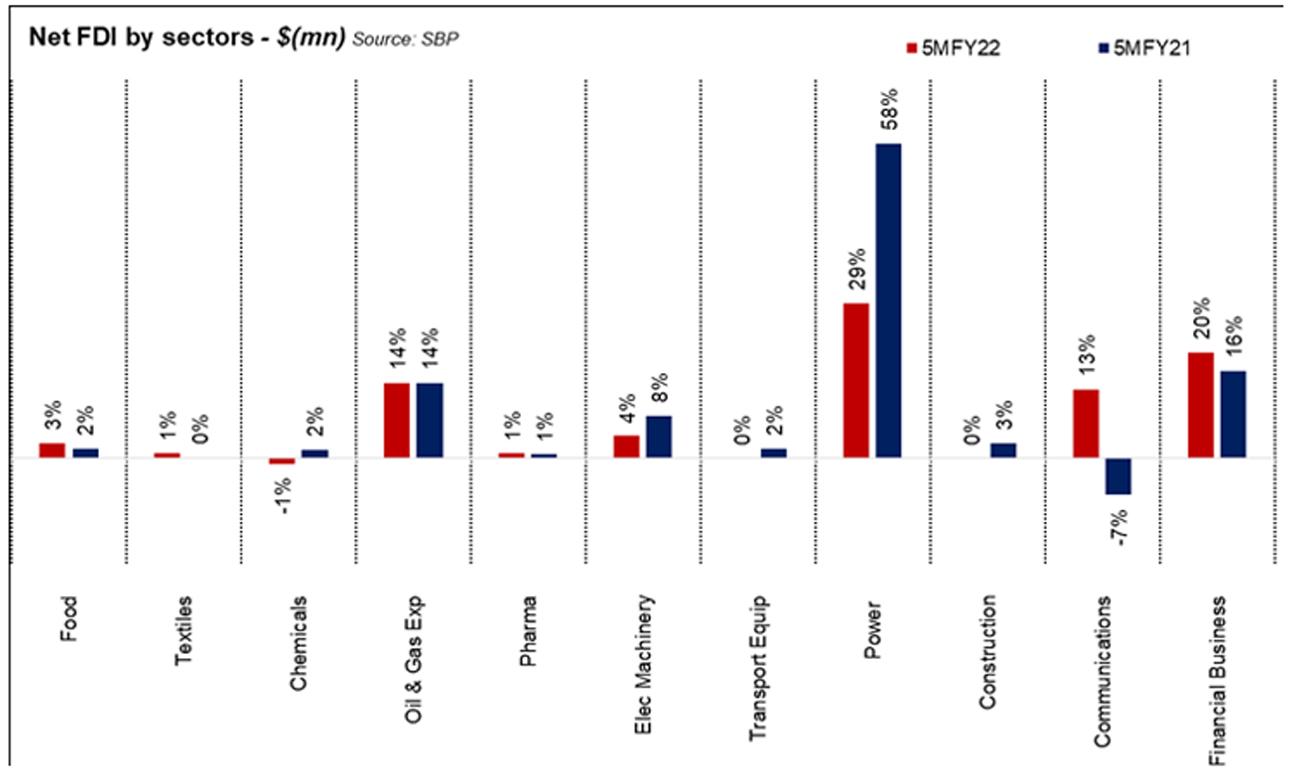

Amid continued promises and claims for good omen, foreign direct investment landscape in Pakistan has been lackluster. While net FDI in 5MFY22 has increased by 12 percent year-on-year, the total tally of around $800 million is trivial. Total FDI inflows in 5MFY22 as per SBP’s recent data is actually down by over 9 percent year-on-year.

Though FDI in Nov-21 turned positive from a negative net tally in Nov-20, it wasn’t anything inspiring. And FDI inflows in Nov-21 were down by 30 percent year-on-year.

Lower inflows and higher outflows describe the general FDI trend in the country highlighted by reliance on limited sectors and countries. Lack of investor appetite amid declining Greenfield projects has been driving FDI down in many developing countries due to lack of mobility, travel, investor road shows etc. Decline in investor activity in the country’s oil and gas upstream and downstream segments have been due to oil price crash during the pandemic. However, where crude oil prices have risen to record level again, FDI in the E&P sector remains stagnant partly because of rise in environmental awareness and hence lower investment in fossil fuel as well as pull out from existing projects.

While globally, foreign investments have severely suffered in the last couple of years due to the pandemic, local factors have plagued this source of foreign exchange for too long. SBP’s annual report mentions sector-specific activity in a few segments of the economy for many years as drivers of FDI e.g. CPEC projects particularly power projects and reliance on China; and auctions of telecom spectrums or when license fees of cellular firms become due.

This can also be seen in slowdown in power sector investments in coal under CPEC by China. The latest annual report of the central bank highlights that China – the world’s largest coal consumer – is reassessing coal’s usage as a major fuel source within its own borders, as well as for power projects under the Belt and Road Initiative (BRI). Even though inflows in coal power projects have fallen by 62 percent year-on-year in 5MFY22, the power sector is still the largest contributor to overall FDI in the country - depicting the lack of diversification in these foreign flows.

Comments

Comments are closed.