Like many furnace oil-based power plants, Engro Powergen Qadirpur Limited (PSX: EPQL) has continued to face lower generation levels as power generation has shifted to coal, LNG and hydel. The power company’s latest financial performance for the first six months of 2020 is a depiction of the same trend.

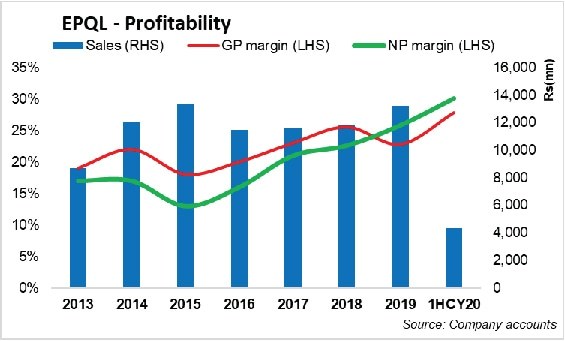

EPQL announced its 1HCY20 financial performance last week, and the company saw its revenues decline by 40 percent year-on-year. The decrease in sales revenue is mainly attributable to lower power dispatch in 1HCY20 as compared to the same period in the preceding year. Lower dispatches mean that the company’s electrical output remained lower, and hence lower offtake from the power purchaser, which is shown by the load factor. While the figures for 1HCY20 power dispatches are not available, EPQL’s load factor was 37 percent in 1QCY20 versus 67 percent in 1QCY19, and it is expected that it was even lower in 2QCY20 because revenue was down by over 60 percent year-on-year during the quarter.

However, unlike the previous quarters, the company did not benefit from the lower cost associated with lower power dispatch. Where the 1QCY20 saw gross profit and margins improve on the back of lower cost of sales and higher capacity payments due to indexation, 2QCY20 gross profit declined by 71 percent year-on-year, and the gross margins by 60 basis points which affected the overall 1HCY20 profitability.

And growth in earnings in 1QCY20 of around 26 percent was eaten away by the 64 percent decline in 2QCY20. Despite no significant increase in cost pressure and growth in other income as well as finance income earned on receivables versus finance cost, EPQL’s net earnings in 1HCY20 was down by 30 percent year-on-year.

A major threat to EPQL continues to come from overdue receivable from NTDC and SNGP, which stand at alarming levels. The IPP has been producing electricity on mixed mode with gas and HSD since September 2018 due to decline in supply from Qadirpur field. But EPQL has initiated process of finding a long-term alternate fuel option to replace the expensive HSD.

Significant decline in revenues shows that power generation demand remained weak in the last quarter of FY20 amid the COVID-19 and slow industrial activity. However, there might be some respite in the coming quarter for EPQL as the country has now been completely opened for business, which will spur power demand.

Comments

Comments are closed.