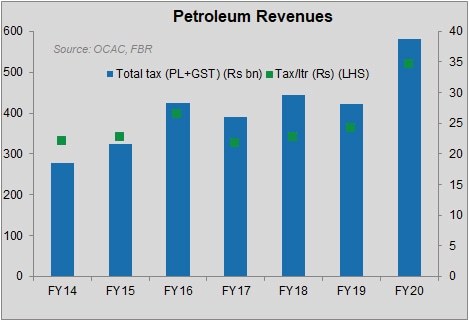

Had all other avenues responded as well as petroleum, the FBR could have even achieved the pre-Covid tax target. Tax revenue on key petroleum products (petrol and HSD) went up by a considerable 38 percent year-on- year in FY20.

Although, petrol sales picked up dramatically in the last two months to end up at 9.5 billion liters at almost similar level of FY19, the HSD sales were 9 percent lower year-on-year at nearly 8 billion liters. This is also the first time in recorded history that petrol sales have superseded that of HSD. The combined petrol and HSD sales were lower by 4 percent year-on-year at 16.8 billion liters – yielding a 38 percent increase in tax revenues at Rs582 billion.

There is good news on Petroleum Levy (PL) front too. Against the revised amount in the budget of Rs260 billion – the expected revised amount will be north of Rs310 billion. The last quarter of FY20 alone has yielded more than one-third of full year PL, as the PL reached the upper limit in the last two months, and June saw the highest ever monthly sales, at the highest ever PL in rupee terms.

In terms of PL and GST composition – the PL has crossed GST for the first time ever. And by some distance too. The PL incidence was more than double at Rs23/ltr, versus Rs11/ltr in lieu of GST on petrol and HSD combined.

Whether or not this is a calculated move to have more in PL as the amount does not become part of the divisible pool – will be best known if the oil prices go up and the government lowers the GST rate instead of the PL. FY20 saw continuation of standard 17 percent GST on booth petrol and HSD – which was aided by relatively lower oil prices throughout the year, and the retail prices was largely manageable. Recall that the government has set an unrealistically high PL target of Rs450 billion for FY21, which seems out of reach from day one, and could only be met, if the GST gets reduced massively.

In terms of total tax incidence, FY20 was the highest ever at Rs34/ltr for petrol and HSD combined. So, while the tax on petroleum may still be the lowest in the region and amongst the lowest in the world, any criticism that the government attracts on this front, would not be ill-founded.

Comments

Comments are closed.