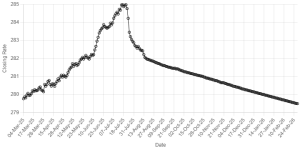

From US to Ukraine, dry weather and draught have battered crops hard, and the resulting price spikes are battering the poor. World Bank, in its latest Food Price Watch, has reported a 10 percent month on month rise in July 2012 due to severe climate in Eastern Europe and United Sates. Food prices have remained volatile for a while, and the weather associated risk premium is the critical factor behind the food prices uncertainty and escalation. From the enormous damage to US soybean and maize crop to agricultural losses in Ukraine, Russia and Kazakhstan, weather conditions have toppled the expectation for 2013 crop yields and outputs. Where on average, crude oil rose by seven percent month on month in July, wheat and maize prices surged by 25 percent, soybean jumped by 17 percent, sugar climbed by 12 percent, while rice prices fell by four percent, MoM. To start off with how these latest spikes in prices of soft commodities could affect the world especially developing and poor countries, the forecasts about trade and inflation around the globe will require the incorporation of a big weather risk premium. With volatility in food prices, inflationary pressures are building up. This will be an undesirable development for not only regions like the Middle East, which relies on imports of food, but also for economies where economic activity is struggling. Also, the thought of prices increase is spooking the health and well being of millions of people living in developing countries, particularly Africa and South Asia where poverty is already a burning issue. Whether temporary or permanent, socio economic impacts of the prevailing draught are thus impending. With the fears of food availability and affordability not frittering away any time soon, the Economist Intelligence Unit has also foretold that staple prices would remain on the higher side of the price spectrum due to tighter markets. Going into 2013, the views are generally tinted with skepticism. For example the EIU articulates that on one hand, the supple rice markets can keep prices of the staple down, while on the other hand, the soft commodity has a slender international trade. Like the geopolitical risks facing the oil market, food prices have also been subject to an exogenous factor: extreme weather conditions and any major shock here has the tendency to aggravate the situation in any direction.

From US to Ukraine, dry weather and draught have battered crops hard, and the resulting price spikes are battering the poor. World Bank, in its latest Food Price Watch, has reported a 10 percent month on month rise in July 2012 due to severe climate in Eastern Europe and United Sates. Food prices have remained volatile for a while, and the weather associated risk premium is the critical factor behind the food prices uncertainty and escalation. From the enormous damage to US soybean and maize crop to agricultural losses in Ukraine, Russia and Kazakhstan, weather conditions have toppled the expectation for 2013 crop yields and outputs. Where on average, crude oil rose by seven percent month on month in July, wheat and maize prices surged by 25 percent, soybean jumped by 17 percent, sugar climbed by 12 percent, while rice prices fell by four percent, MoM. To start off with how these latest spikes in prices of soft commodities could affect the world especially developing and poor countries, the forecasts about trade and inflation around the globe will require the incorporation of a big weather risk premium. With volatility in food prices, inflationary pressures are building up. This will be an undesirable development for not only regions like the Middle East, which relies on imports of food, but also for economies where economic activity is struggling. Also, the thought of prices increase is spooking the health and well being of millions of people living in developing countries, particularly Africa and South Asia where poverty is already a burning issue. Whether temporary or permanent, socio economic impacts of the prevailing draught are thus impending. With the fears of food availability and affordability not frittering away any time soon, the Economist Intelligence Unit has also foretold that staple prices would remain on the higher side of the price spectrum due to tighter markets. Going into 2013, the views are generally tinted with skepticism. For example the EIU articulates that on one hand, the supple rice markets can keep prices of the staple down, while on the other hand, the soft commodity has a slender international trade. Like the geopolitical risks facing the oil market, food prices have also been subject to an exogenous factor: extreme weather conditions and any major shock here has the tendency to aggravate the situation in any direction.

Don't Miss the Latest News

Subscribing is the best way to get our best stories immediately.

Comments

Comments are closed.