There has been a visible downward streak in petroleum consumption in the country. The OMC data by the OCAC shows this trend of falling sales of petroleum products by oil marketing companies. Whether it is for the latest month – Dec-22 on a month-on-month basis, year-on-year basis, or for overall CY22 or 1HFY23, petroleum sales can be seen coming down.

In December 2022, overall petroleum sales declined by 11 percent year-on-year. The sale was down by 14 percent as compared to Nov-22. Product-wise, the decline was seen in all three key products – both year-on-year and month-on-month. Furnace oil was down by 3 and 10 percent year-on-year and month-on-month, respectively. High-Speed Diesel declined by 15 and 22 percent, year-on-year, and month-on-month, respectively. And Motor Spirit sales in December-22 were weaker by 11 and 8 percent, year-on-year, and month-on-month, respectively

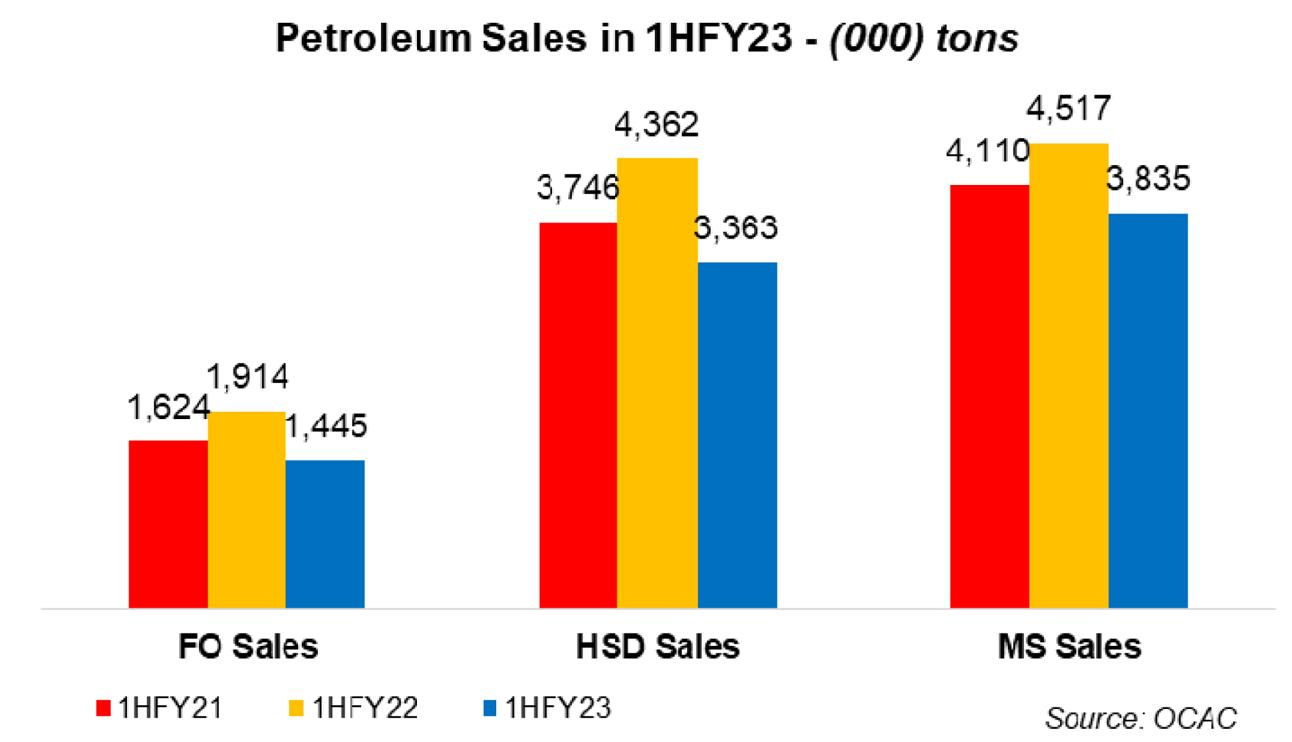

Overall, in 1HFY23, petroleum sales were down by 19 percent. All three major petroleum products posted a declining trend (FO, HSD, and MS down in double digits by 25. 23 and 15 percent YoY)

The decline in all aspects indicates the current situation of the economy. The slump in oil consumption has been triggered by weak economic activity and outlook. The decline in economic activity has led to weak LSM, a contraction in car sales, and weaker agricultural productivity. Moreover, the floods in 2022 restricted transport and agriculture, and irrigation activity, which also added pressure to petroleum consumption in the country. And then the high inflationary wave going on in the country has been restricting the growth in offtake. Plus, the winter season and higher prices have also been restricting the consumption of furnace oil in the power sector and retail fuels in transport due to winter school break.

The outlook for petroleum consumption is anything but sanguine. Continued political uncertainty and economic upheaval will likely dictate the petroleum offtake in the country – which does not look promising as of now with GDP growth for FY23 projected to be less than one percent. The imposition of GST and PDL on petroleum products will add further pressure to weak volumes.

Comments

Comments are closed.