Oil and Gas Development Company Limited

The country’s largest E&P company - Oil and Gas Development Company Limited (PSX: OGDCL) with operations including exploration, drilling operation services, production, reservoir management, and engineering support has the largest exploration acreage in Pakistan covering around 41 percent of total acreage awarded as at March 31, 2022. In the last fiscal year, the company contributed to 29 percent of Pakistan’s total natural gas production, and 48 percent of its oil production, and 37 percent of its LPG production in FY21. The E&P player’s exploration portfolio comprises 48 owned and operated joint venture exploration licences as per the latest data till March 31, 2022. Additionally, the company possesses working interest in nine exploration blocks operated by other E&P companies.

Shareholding Pattern

The Government of Pakistan is the largest shareholder in OGDCL with over 67 percent, followed by OGDCL Employee Empowerment Trust and Privatisation Commission of Pakistan. A breakup of shareholding pattern is given in the illustration.

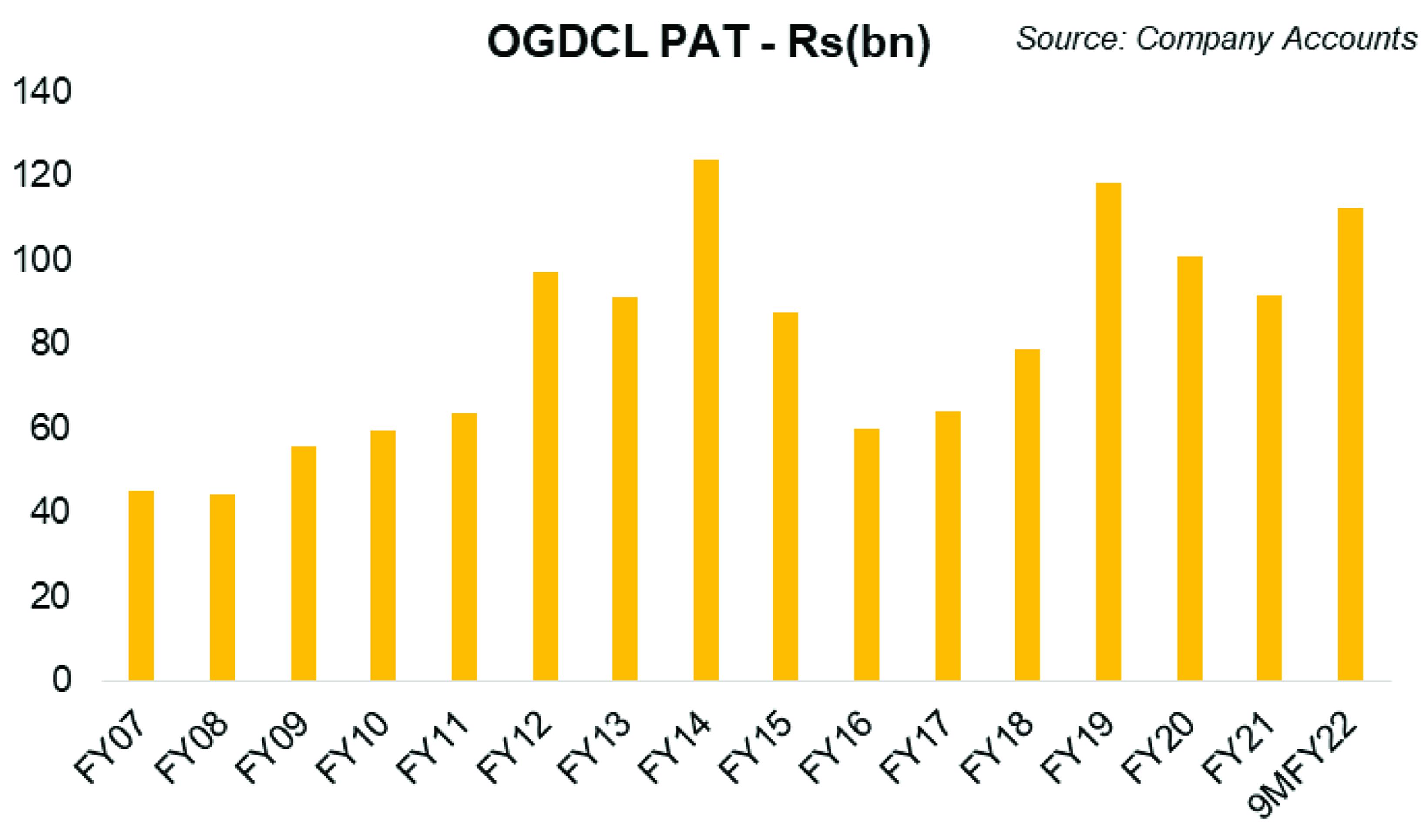

OGDCL in the recent past

OGDCL is one of a leading E&P companies because of its aggressive exploration and drilling activities over the course of its history. The steady rise in its production flows amid depleting country reserves show the strength of the company. This has also been accompanied by a steady rate of discoveries. The company recently discovered new oil and gas reserves in Sindh and Punjab.

In FY18, OGDCL’s oil volumes continued to rise, while the company faced a decline in gas volumes sold due to lower production. Profitability of the company continued to improve primarily due to modest recovery price of crude oil. Plus, higher LPG production complemented by favourable exchange rate and planned capital spending contributed positively to the financial growth in FY18. However, the company faced increase in operating expenses, depreciation and higher cost of dry and abandoned wells owing to 11 wells declared dry and abandoned in FY18 against 4 wells in FY17 that impacted earnings.

In FY19, rise in revenues again came from higher average realised crude oil prices and higher average realised gas prices. OGDCL’s revenues were seen climbing by 27 percent year-on-year and bottom-line expanded by 57 percent year-on-year. Crude oil and gas production remained flat, while LPG production increased during the year. Also, rise in average exchange rate, and increase in other income and share of profit in associate accompanied with decline in exploration and prospecting expenditures strengthened the profit after tax. However, profitability in FY19 continued to be affected increase in operating expenses mainly on account of amortization expense.

OGDCL’s bottom-line slipped by 15 percent year-on-year in FY20 due to crashing oil prices along with Covid. The squeeze in earnings started from the top as revenues decreased by 6 percent year-on-year. The decline was both due to falling crude oil prices and production levels. Realized prices of crude oil witnessed a drop of around 20 percent whereas LPG realized prices also fell by 11 percent in FY20. Production numbers were also subdued as Covid-19 left many fields in partial shutdown mode. The company also incurred an increase in operating expenses, which aided the decline in gross profits. Absence of exchange gains restricted other income growth and increase in all expenses including exploration, general administration, and finance cost also impacted the bottom-line. Growth in exploration expenses was due to significant cost of dry and abandoned wells during the year.

The E&P sector witnessed recovery in FY21. The trend of falling average gas production continued in FY21. However, some recovery was witnessed by OGDCL in its crude oil production. Along with the increase in crude oil and LPG production volumes, average realised prices for natural gas up by 8 percent year-on-year were the driving factors for revenue growth for OGDCL in FY21. However, decline in gas production as well as flat crude oil realised prices offset the gains, and OGDCL’s topline grew marginally by 2.65 percent in FY21. Earnings for the E&P Company grew by 9.3 percent year-on-year, which was supported by a five percent year-on-year decline in the exploration and prospecting expenditure during the year. However, the profitability during the year was affected by reduction in other income due to exchange loss and decline in interest income, and higher operating expenses primarily due to higher amortization, development and repair cost.

FY22 and beyond

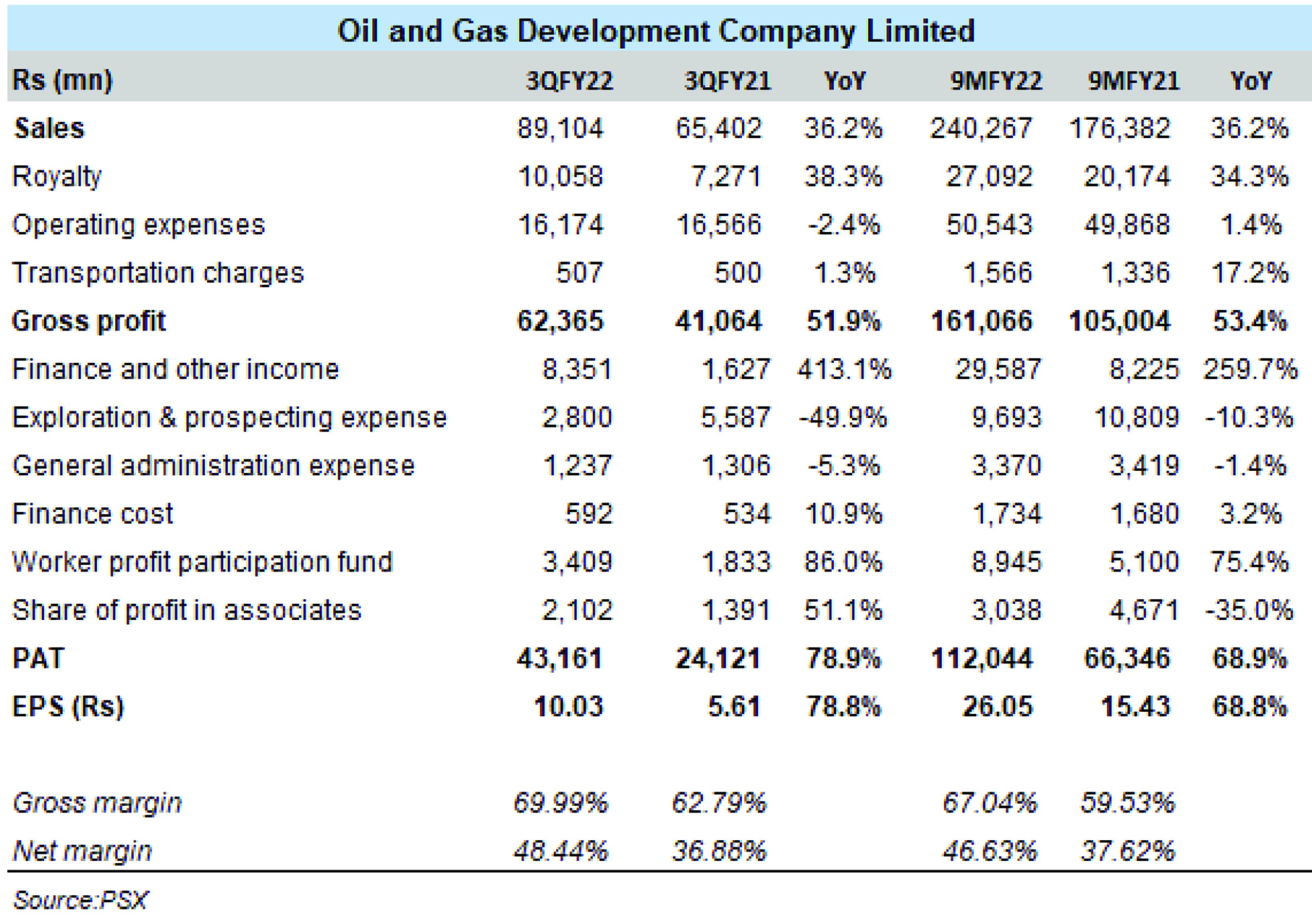

OGDCL’s profits were gushing in 9MFY22 as high oil prices along with currency depreciation have been key factors of growth in the revenues of oil and gas exploration and production sector in FY22 so far. OGDCL’s revenues increased by 36 percent year-on-year in both 3QFY22 and 9MFY22 because of spiking international oil prices amid rising demand as well as geopolitics, and depreciation of local currency significantly contributed to the growth. The average realized price of crude oil was up by 63 percent in 9MFY22 year-on-year. However, the production side has been slipping primarily due to natural decline in fields; crude oil average daily production was down by four percent year-on-year, while natural gas average daily production was down by two percent year-on-year. Nonetheless, decline in oil and gas production was partially mitigated by injection of eight operated wells by the E&P Company.

Apart from the rise in topline, the growth in OGDCL’s bottom-line was also due to increase in other income coming from hefty exchange gains from currency depreciation. Finance and interest income grew by 3.5 times in 9MFY22. On the expenditure side, there was a drop of 10 percent year-on-year in exploration and prospecting expenditure in 9MFY22.

Oil prices have continued to drive earnings for the E&P sector and the prices are not coming down. Currency depreciation has been a companion in driving the E&P sector’s earnings. The company’s bottom-line was seen growing by 69 percent year-on-year in 9MFY22.

Comments

Comments are closed.