Kohat Textile Mills Limited (PSX: KOHTM) was established in 1967; however, it did not start commercial production until 1970. It is a subsidiary company of the holding company, Saif Holding Limited. The latter holds nearly 78 percent of the shares in Kohat Textile Mills. The main business of the company is the manufacture and sale of yarn, limited to the domestic market.

Shareholding pattern

Saif Holding Limited, which is the holding company of Kohat Textile Mills, holds majority of the shares, at nearly 78 percent. About 10 percent is held by banks, DFIs, NBFIs, and the local general public, each. The directors, CEO, their spouses and minor children hold close to 1 percent of the total shares of the company.

Historical operational performance

Kohat Textile Mills financial performance has been more or less similar to most other yarn manufacturers in the industry, with profit margins dipping in FY16 before gaining again in FY17 onwards.

During FY15, the company’s topline increased by almost 5 percent. This was mostly attributed to the increase in capacity which led to higher production; there was an almost 17 percent incline in production during the year. While there was a negligible change in the other factors of the financial statement, cost of production increased to consume a little beyond 91 percent of the revenue. This was largely brought in by an increase in salaries expense. It was noted that minimum wages had nationally increased in FY15, more so in the province of Khyber Pakhtunkhwa (where the mill is located), however, it was later fixed at the national level. Thus, profit margins slipped year on year.

Revenue fell by more than 7 percent in FY16, the highest decline seen in almost a decade. The textile industry as a whole had seen a slump due to a slowdown in global demand. This also affected prices in the domestic market, hurting profitability for a lot of the manufacturers. Local industry players, including Kohat Textile Mills faced competition from availability of cheaper imported yarn coming form India. While the overall textile exports declined in FY15 by 7.4 percent, yarn exports went even further down by nearly 32 percent. As a result, cost of production increased to make up 94 percent of the revenue, leaving little room for absorption of other costs; thus, the company incurred a loss of Rs 19 million.

Marginal recovery was seen in FY17 as topline increased by less than a percent. According to the company’s report, there was a mixed sentiment whereby demand improved, however, the local market remained more or less stagnant. This was so due to cheaper imported yarn available in the local market, which continued to hurt the profitability as prices were affected. Most of the improvement in profitability was brought about by cost curtailment, coming from lower consumption of raw materials. Thus, the year ended on a positive note for the company.

Growth in revenue was again flat in FY18, as it grew by less than a percent. A lot of the companies that were also present in the export market had benefitted from the currency devaluation of FY18 and increased profitability. Since Kohat Textile Mills is not an exporter, therefore its growth remained subdued with only a fall in cost of production as a percentage of revenue allowing improvement in gross margins. However, net margin fell below 1 percent due to finance cost; latter made nearly 3 percent of the revenue, due to increase in short term borrowings.

Revenue jumped by 32 percent in FY19- the highest increase seen in almost a decade. This was attributed to better sales price for the company’s product. In addition, cost of production also reduced, albeit marginally, thus keeping profit margins in check. Finance cost witnessed an increase, both in absolute terms, as well as a percentage of revenue. This was due to the rising borrowing cost. despite, the increase, the improvement in topline was translated to the bottomline, with the latter clocking in at Rs 67 million.

Quarterly result and future outlook

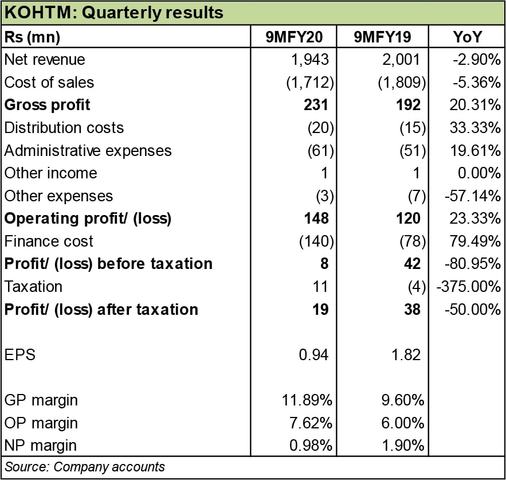

Revenue declined by nearly 3 percent in 9MFY20 year on year. However, the decline in cost of production exceeded the decline in sales revenue, allowing gross and operating margins to improve. But the benefit of this was not reflected in the bottomline as the latter halved year on year. This was due to the near doubling of finance cost due to higher borrowing cost in FY20. Therefore, net margin reduced to less than a percent.

There has been a demand contraction undoubtedly. Supply side has been equally affected with mills either shutting down or operating at low capacities. Companies with a high leverage are most likely to find themselves in a cash strapped situation. The company hopes that efforts to cut costs would help to keep the company afloat.

Comments

Comments are closed.