Relief for cotton: a loss for exports?

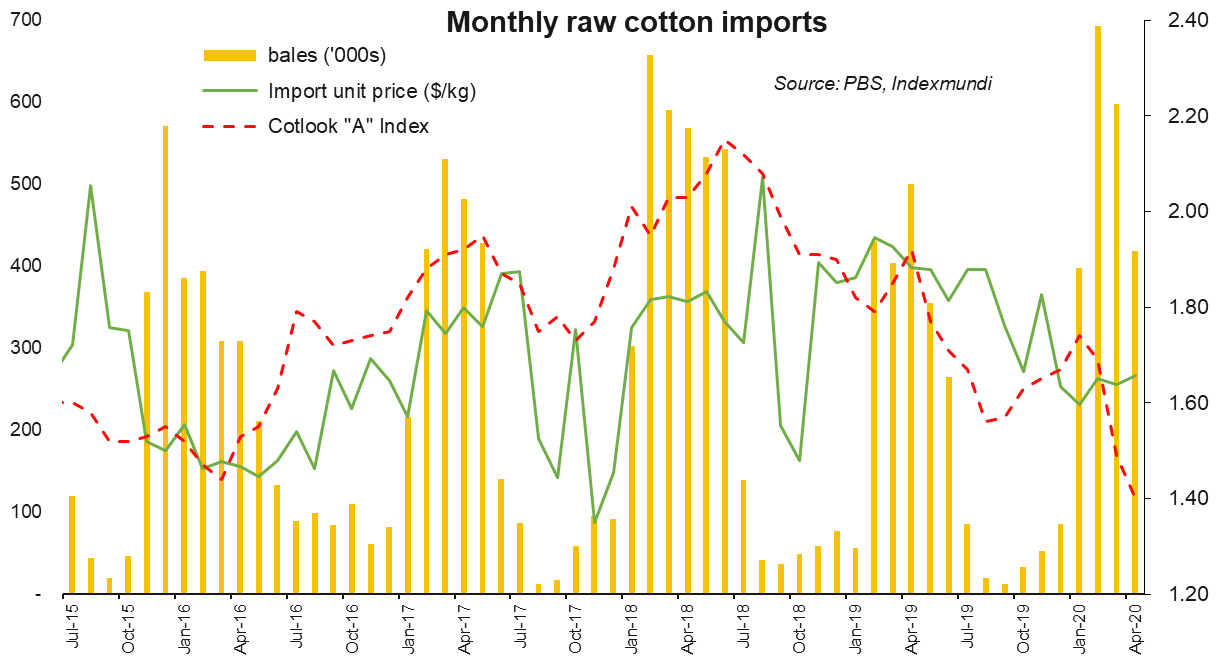

After witnessing highest ever monthly volume in Feb-20, cotton imports in April were down by 40 percent from its peak two months ago. Two months into lockdown, this comes as little surprise as global textile demand has eviscerated in the aftermath of Covid-19; but have put a dent in predictions of highest ever import bill in 30 years.

Recall that Pakistan recorded its lowest ever cotton output in the outgoing season at 8.55 million bales, falling short of estimated domestic consumption of 14-16 million bales by nearly 50 percent. Varying estimates of import were put forth, given the low opening stock position with spinning mills. Although clarity had been established on poor crop outlook way back in Sep-19, imports did not begin to trickle until the second half of fiscal year due to steep custom duty on import till the completion of harvest in Jan-20.

Once the duty was lifted in second week of Jan-20 – a regular practice to protect local growers and ginners – imports picked up like a charm, evidenced by import of 1 million bales in 6 weeks till Feb-20. Market insiders placed forecast of imports for Mar-June at 0.8 – 1 million bales per month, confirmed by news flow from banking channels that large spinners had booked sizable forwards for import way back in Oct-19.

Now that the orders have been cancelled or delayed, it appears that floor may fall out in the remainder two months of the fiscal year. According to Karachi Cotton Association, trading was suspended for nearly a month beginning last week of March and has shown no sign of life ever since business resumed officially a fortnight ago. Spot price is holding ground at Rs8,760 per maund, quietly hoping for a reversal in fortune.

Meanwhile, international cotton prices are at their lowest for at least past 5 years and are showing no signs of changing gears any time soon. Six-month rolling average of Cotlook “A” index indicates that spot prices are having their longest bear run since 2015-16, when bumper crop in top producing countries took prices down to $1.56kg for more than a year. Cotton futures for May-21 (365 days) is trading at 61cts/lb, down by 15 percent from Dec-20, long before Covid-19 had become a threat to global economy.

Amidst all of this, a push for imposition of an intervention price for cotton by the federal cabinet is deeply surprising. The proposal, earlier rejected by ECC, had suggested allocation of Rs83 billion package for public procurement of seed cotton at Rs4,200per maund for the soon-to-begin sowing season. This would amount to procurement of 4.3million bales – more than 50 percent of cotton production in FY20 – and a larger governmental footprint in commodity operations than even wheat (in % terms).

At a time of depressed demand forecast, an intervention price set well-above international rate may help pique grower interest in the crop. But at what cost? Government role in procurement operations cannot reverse the slowdown in global textile value chain.

On the contrary, it will increase the price of domestic cotton for the spinning industry making textile products even more uncompetitive in the international market – unless the government decides to set the issue price at (or lower) than international market rate, in which case it will have to show willingness to take a steep blow to exchequer.

At a time when cotton futures are trading at a significant discount than their long-term average, both government and the industry should explore the possibility of removing custom duty permanently, hedging future price risk and booking long contracts. Instead, it appears that constituency politics will carry the day in federal cabinet. A victory for optics may prove a loss for commerce.

Comments

Comments are closed.