Oil market is all bears

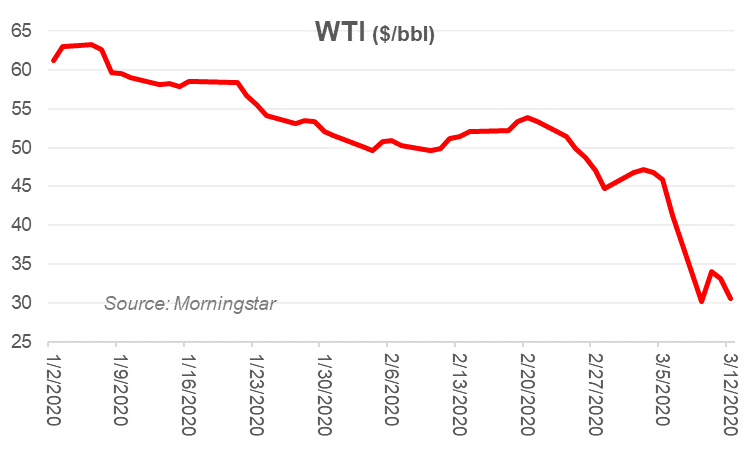

The Tuesday rebound in oil price proved temporary. President Trump’s speech, which was largely being built as the trump card for oil market direction – did more harm than good for oil market. It added to the confusion – and confusion is what all commodity markets hate. Oil prices lost another 10 percent in two days, after a brief respite on Tuesday. WTI was last seen trading at under $31/bbl, close to Monday’s close, when the prices had tanked 30 percent intraday.

It was last trading at near $30/bbl, having lost 7 percent in the early hours of US market trading. What was already a bear market, got the jolt from Trump’s speech. Some had pinned hopes on a large stimulus to fight coronavirus, but Trump stopped short of it. What came instead was a month-long ban on travel from Europe.

Recall that Opec, EIA and other agencies had revised the oil demand forecast significantly downwards, earlier this week. In fact, 2020 is slated to be the first time since 2008, where oil demand is all set to book a negative demand growth. Add to this, the US travel ban from Europe, which adds fuel to fire, and reduces jet fuel demand for the already ailing aviation and travel industry.

Comparisons are being drawn with 2016 oil market oversupply situation. While the market back then was unquestionably oversupplied, which led to the formation of Opec plus group, the glut today, is at unprecedented levels. Not only is the market brimming with supply, the demand has tanked at the same time. And if that is not enough, three major players, Saudi Arabia, Russia and the UAE have separately announced very sizeable increase in production come April 2020.

Saudi Arabia is all set to pump its highest ever production level, and Russia won’t hold back. Both the countries have reportedly offered steep discounts to major buyers – signaling the bearish trend is here to stay for the medium term. There appears nothing in sight that could act as a trigger to reverse the bearish trend. One-fourth of the world in a virtual lockdown is definitely unchartered territory. Technicals have not planned for that. For Pakistan, it may seem a blessing in disguise, but if the crisis deepens, it won’t spare anyone – not even Pakistan.

Comments

Comments are closed.