Remittances - slow but steady

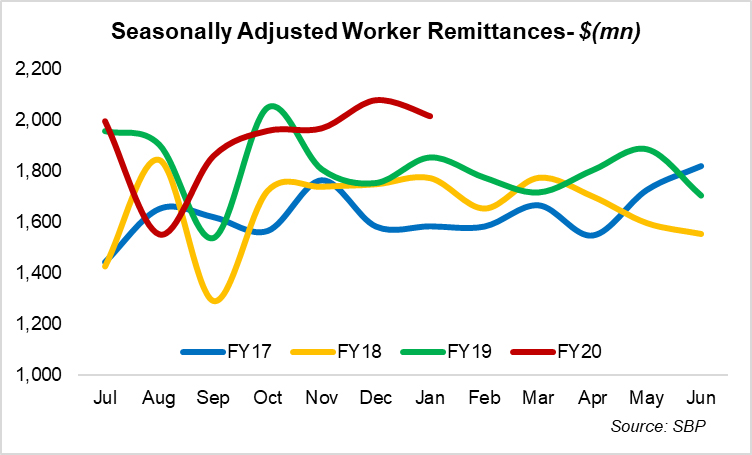

Despite their slow growth, remittances continue to serve as a lifeline for the economy. It so happened that the government’s ramping up initiatives to further boost remittance inflow through formal channels into the country were offset by economic slowdown in key corridors that send in the most foreign exchange. Nonetheless, a steady trend is emerging. This can particularly be seen in the monthly remittances trend chart adjusted for holidays and seasonality.

In January 2020, remittances grew by 9 percent, year-on-year. Growth in overall remittances in 7MFY20 as per the latest official data was around 4 percent year-on-year, primarily restricted due to volatility in the Middle East and slow growth in inflows from the key corridors such as Saudi Arabia, UAE and other GCC that averaged 3 percent. On the other hand, the continued growth in remittances from USA and UK have kept overall remittances buoyed, contributing around 30 percent to the aggregate. In 7MFY20, inflows from USA jumped by 11 percent, while those from UK increased by 5.7 percent year-on-year.

The economic turmoil, diversification away from oil and the challenging employment status in the Middle East has been affecting remittance outflow from key countries in the region. However, it can be seen that in FY20 so far, monthly remittances from these corridors have remained elevated on a year-on-year basis and remittances from these countries have found a new normal, which is not sufficient to propel growth in the country’s remittances landscape but offers some stability.

Some worth mentioning efforts by the government include PRI’s support to Pakistan Post and to the National Bank of Pakistan for enhancing their tie-ups with 41 money transfer operators in the UAE and Saudi Arabia in the recent months as highlighted by SBP’s latest quarterly report.

At the same time, the number of Pakistanis going to Saudi Arabia witnessed a growth of 230 percent year-on-year in CY19 versus consecutive decline in CY16, CY17 and CY18 (12 percent, 69 percent and 30 percent, respectively) as per the data by the Bureau of Emigration and Overseas Employees.

Plans for new accounts for emigrants going abroad and debit cards to send money back home with certain incentives attached are also in the offing. At the same time, increasing the payment limit for freelancers from $5,000 to $25,000 per individual a month through official home remittance channel will also play its role in boosting remittances in the country particularly amid rising freelancers in the IT sector. This could also be one reason for a significant jump in remittances from the US.

Comments

Comments are closed.