The sectors that move people and products and help individuals and businesses connect continue to hold on at 13 percent of GDP. Though some of these growth-enabling activities in the transport, storage and communications (TSC) sectors are dominated by the inefficient public sector (think PIA, Railways, Pakistan Post, etc.), a large private-sector presence helps balance a suppressed equation. So how was FY19 for these sectors?

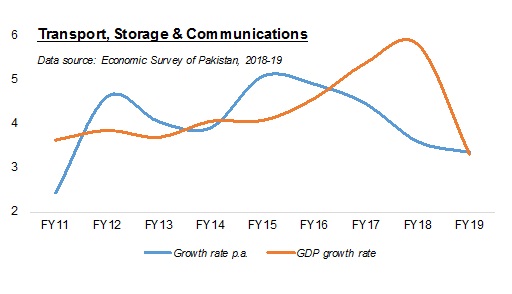

The latest Economic Survey puts growth in the TSC sectors at 3.34 percent. That is lower than the overall Services growth of 4.71 percent but better than the GDP growth of 3.3 percent that has been estimated provisionally for this fiscal. Future growth in TSC depends on the performance of public sector entities, whose funding and efficiency would need to be raised for a beneficial impact on the larger economy. As for the private sector players, clarity in sector policies and fiscal incentives can help.

Let’s take the main sectors one by one. When it comes to building new roads, ongoing work on the CPEC’s three alignments until 2023 will keep pumping hundreds of billions more into highways and motorways projects. The NHA’s funding, already the highest among PSDP recipients, is expected to come on top next fiscal again. This spending will cushion demand and help the logistics sector. Besides highways, Chinese funding will be crucial for Railways ML-1, Eastbay Expressway and Gwadar Airport.

Pakistan Railways has been a surprise performer for FY19. The government has reported that in the Jul-Feb period, Railways’ gross earnings grew over 10 percent to Rs34 billion as passenger and freight traffic recorded decent growth year-on-year. The Railways’ operational trend-line has been gradually improving in recent years. However, a decisive turnaround lays in those tracks carrying most of the country’s cargo.

The PIA, meanwhile, is flying on a different trajectory. As its fleet shrank to 32 planes and route went down to 0.33 million kilometers, the national airline closed CY18 with operating revenue of Rs100 billion. But that number is marred by operating expenses reaching Rs170 billion for the year! Without enlarging its fleet, and providing quality service, and sticking to a select-few profitable routes, it will be unsustainable for the flagship carrier to keep flying in the long run.

Over in the telecoms sector, there is not much to write other than the fact that net FDI in the sector is significantly down even as mobile broadband subscriptions are on a steady rise courtesy prior investments made by 3G & 4G operators. The government needs to revitalize this sector by introducing a predictable spectrum auction process, incentivizing fiber optic connectivity, and reducing broadband-related taxes, with the central objective to boost broadband uptake in the country.

As for the IT sector, it is time to walk the talk on digitizing the government receipts and transfers, creating a centralized IT procurement authority to support local software houses, and rolling out the long-stalled regulatory framework for e-commerce. The budget today will make it clear whether the current government will go beyond the past mantras of establishing software parks and incubation centers and show meaningful fiscal and non-fiscal support for the development of IT sector in Pakistan.

Comments

Comments are closed.