The heydays of fertilizer’s dominance looked over last year. Depressed urea prices subdued sector profitability despite double-digit growth in off-take. But CY18 seems to be the turnaround year, as price per bag has increased 13 percent since June last year.

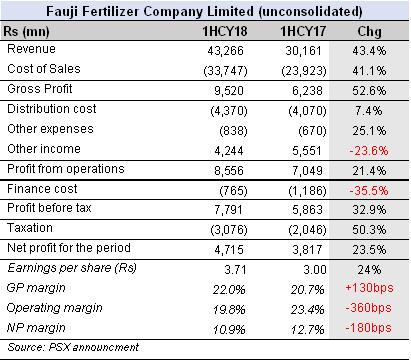

For Fauji Fertilizer Company Limited (PSX: FFC), the market leader, this meant buoyancy in top-line not seen since CY11. In the six-month period ended June 30, 2018, the FFC top-line grew by a massive 43 percent year-on-year, with gross margins improving by 130bps.

Note that overall urea off-take in the country has remained stagnant, with a steady one percent increase in 1HCY18 over same period last year. This stagnation had no adverse effect on FFC’s performance, as analysts note that company’s urea off-take increased by 13 percent on year-on-year basis during period on review.

This volumetric growth comes on the back of already high-base effect last year, when FFC’s full-year fertilizer off-take grew by 22 percent due to low prices, which had resulted in an unprecedented million tons urea off-take during the month of June-17 alone. Therefore, it would be optimistic to expect urea off-take to grow any higher than single-digits this year.

Thus, the sector – and FFC more so, as it is the market leader – is dependent upon price increase to maximize its performance. And the company has not disappointed its shareholders. While the threat of cheap urea import had kept a gun to domestic producer’s head till CY17, a rally in international urea prices since the beginning of this calendar year means the sector can continue to pass on any increase in feedstock prices.

During the past two years, investors witnessed an increase in reliance on non-core income from FFBL as profitability from core business took a dip; However, the trend has reversed this year, as ‘other income’ recorded a whopping decline of 23.6 percent during the period under review, resulting in a trimmed bottom-line by PKR 1.3 billion, despite the top-line growth.

Going ahead, FFC’s profitability may face threat of a decline in international prices, which could, in turn, bring prices in local market under pressure. Fertilizer off-take is already at its peak, and realistically, urea application is not expected to exceed more than six million tons on an annualized basis.

Even so, it is not a lost cause for FFC by any stretch of imagination.

The company still produces urea at over 100 percent plant efficiency and expects to sell it all. Should the international prices increase further, it could offer an additional breather to the company in terms of contribution margins.

Even without it, strong contribution from ‘other income’ is likely to be a constant stream from the diversified investment portfolio, which FFC now boasts of.

Comments

Comments are closed.