KSE-100 retreats 0.64% as rupee falls further

- Weakening macroeconomic cues dent investor sentiment

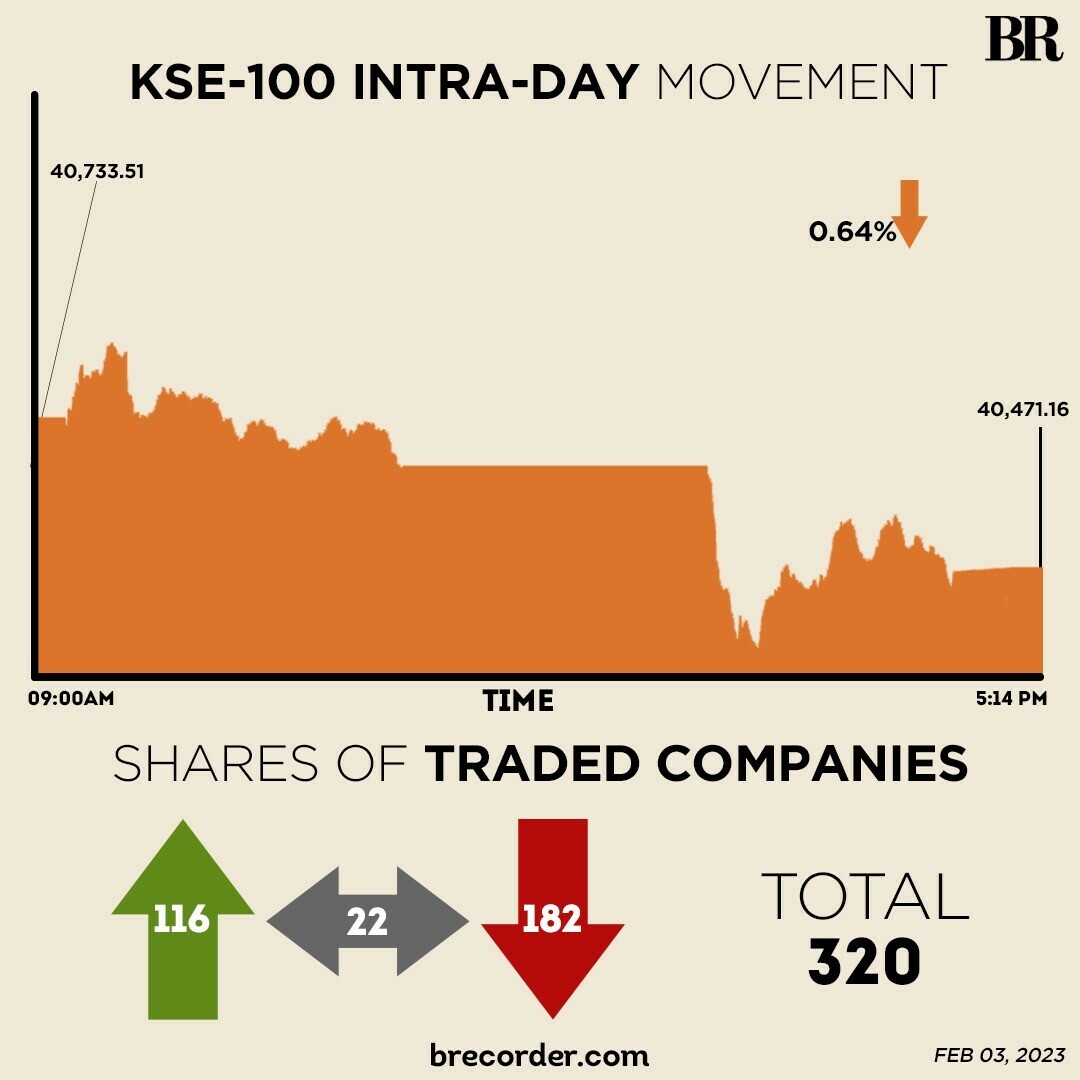

The Pakistan Stock Exchange (PSX) endured a topsy-turvy trading session on Friday and the KSE-100 Index retreated 0.64% owing to further depreciation in the rupee.

Weakening macroeconomic cues dented investor sentiment and sparked negativity at the equity market.

At the end of the session, the KSE-100 Index was down 262.35 points or 0.64% to close at 40,471.16.

KSE-100 rises 0.28% in volatile session

The day began upward but the market traded in a narrow range in the first session. The second session began with a plunge but the market erased few of the losses before closing in the red.

Index-heavy automobile, cement, banking, oil and fertiliser sectors closed in the red.

A report from Arif Habib Limited (AHL) stated that the week wrapped on a sombre note for PSX, as the market closed in the red at the closing bell.

“The benchmark KSE-100 index had a range-bound opening session as investors’ activity remained sluggish owing to the prevailing ambiguous political environment in the country. The second session began with the same negative sentiments, with the dollar pounding the rupee in the inter-bank market, further eroding investor confidence as the index hit an intraday low of 403.76 points.”

A report from Capital Stake stated that the PSX took a U-turn from the previous session closing last session of the week in red.

“Indices slipped lower and lower for most part of the day while volumes dwindled from previous close,” it said.

On the economic front, foreign exchange reserves held by the State Bank of Pakistan (SBP) dropped a massive $592 million to a mere $3.09 billion, data released on Thursday showed.

This is the lowest level of central bank reserves since February 2014. Total liquid foreign reserves held by the country stood at $8.74 billion.

Moreover, rupee slipped to another all-time low against the US dollar on Friday, closing at 276.58 after a decline of Rs5.22 or 1.89%.

Sectors painting the benchmark KSE-100 index in red included miscellaneous (77.70 points), fertiliser (51.67 points) and banking (43.67 points).

Volume on the all-share index fell to 105.1 million from 124.1 million on Thursday. The value of shares dropped to Rs4.2 billion from Rs6.1 billion recorded in the previous session.

Hub Power was the volume leader with 7.9 million shares, followed by Cnergyico with 7.5 million shares and Dewan Motors with 5.7 million shares.

Shares of 320 companies were traded on Friday, of which 116 registered an increase, 182 recorded a fall and 22 remained unchanged.

Comments

Comments are closed.