Another exercise of clearing the energy sector circular debt stock via dividends, Sukuks, or direct cash transfer is never too distant in Pakistan. Why the circular debt keeps coming back does not seem to concern for the policymakers There is always a way to clear the stock. Hopes were built around the recent price rationalization exercise to take care of the circular debt.

Price rationalization will surely go a long way in doing that. Sticking within the funded subsidies also helps arrest the flow – and that bit has been visible. But year after year, the elephants in the room keep getting bigger. The distribution companies continue to go unpunished for consistently remarkably poor performance.

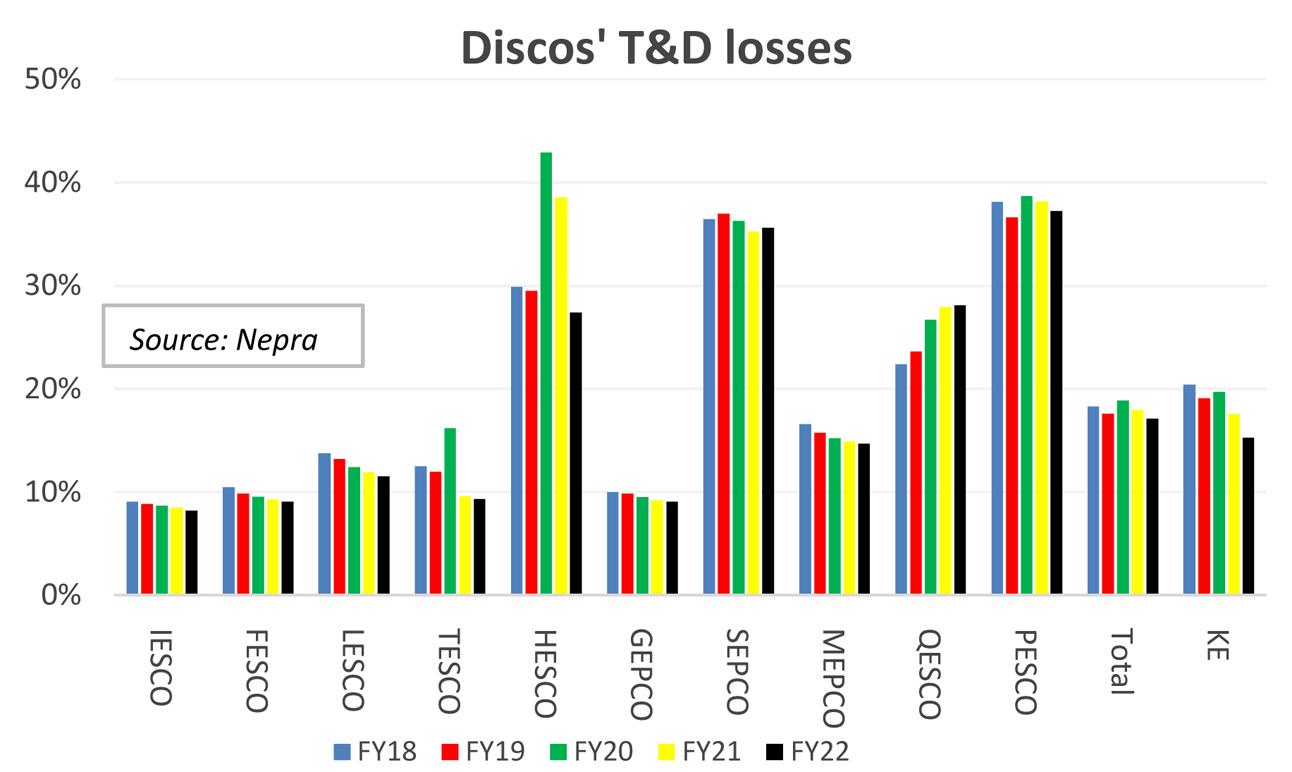

The recently released Performance Evaluation Reports of Distribution Companies for FY2021-22 reiterates the sorry state of affairs at power discos. The oft-cited weighted average T&D losses at 17 percent is barely a percentage point improved from six years ago. The impact in financial terms is Rs122 billion only on account of the allowed T&D targets being missed. Recall that distribution companies ‘are allowed 13.4 percent in lieu of T&D losses to the extent that it gets covered in consumer end tariff.

The pattern within is extremely concerning with the good ones staying good and the bad ones either staying bad or turning worse. The overall T&D losses target keeps getting lower every year, meaning a higher financial impact every year – especially when the generation price is also on the rise. Only three discos have T&D losses within the allowed limit. On the other extreme, the three worst-performing ones – run losses as high as 36 percent.

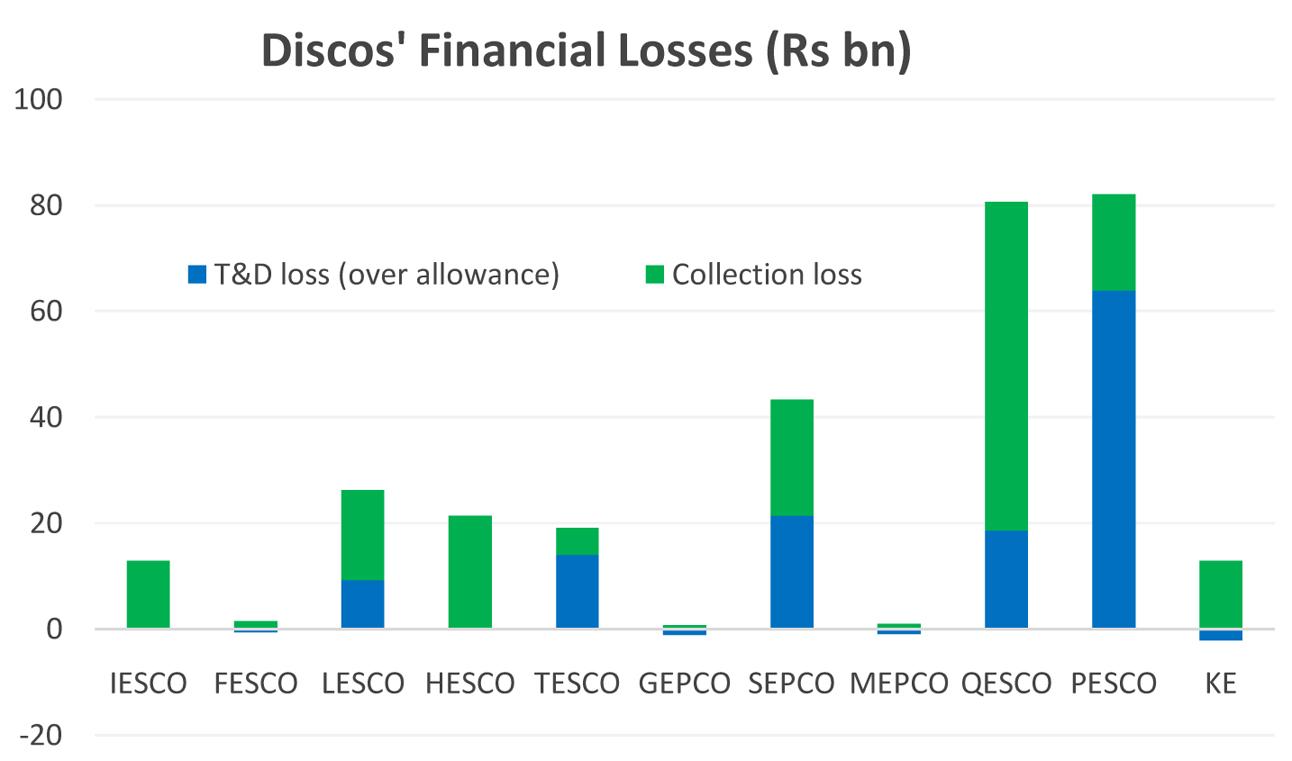

Then there are losses related to a lower collection rate – which is a bigger problem than T&D losses in the sense that Nepra expects and incorporates 100 percent billing collection in the consumer end tariff determinations. Much like T&D losses, collection rates have also moved ever so slowly in the last six to seven years. The total financial impact in FY22 alone resulting from collection losses is Rs175 billion.

Together, T&D losses and billing collection losses – provided a head start of close to Rs300 billion for FY23. A monthly average of Rs25 billion is therefore almost built into the system as ground zero for circular debt. With tariffs slated to increase in the foreseeable future – expect losses to mount further.

Whatever the discos are doing or not doing, is not working. The bad-performing ones have long been a blot and the failure to do anything about them will continue to choke the entire power sector chain. The performance in terms of voltages, interruptions and load shedding is not anything to write home about either. Unbundling the sector is the only way forward, and this has been clear for at least 15 years. No amount of price rationalization will ever work without addressing the core of the problem that lies with discos’ efficiency.

Comments

Comments are closed.