Plenty of analysts have had sleepless nights over the ballooning energy import bill. Calls to curb demand have been plenty. As Pakistan is seemingly moving towards ending the subsidy on petroleum and electricity (which will have lasted six weeks), current account watchers expect a major relief on imports. How much of an impact will an increase in retail price has on petroleum consumption (if any at all) will soon be known. But the energy import bill is not going down anytime soon, even if petroleum demand goes down.

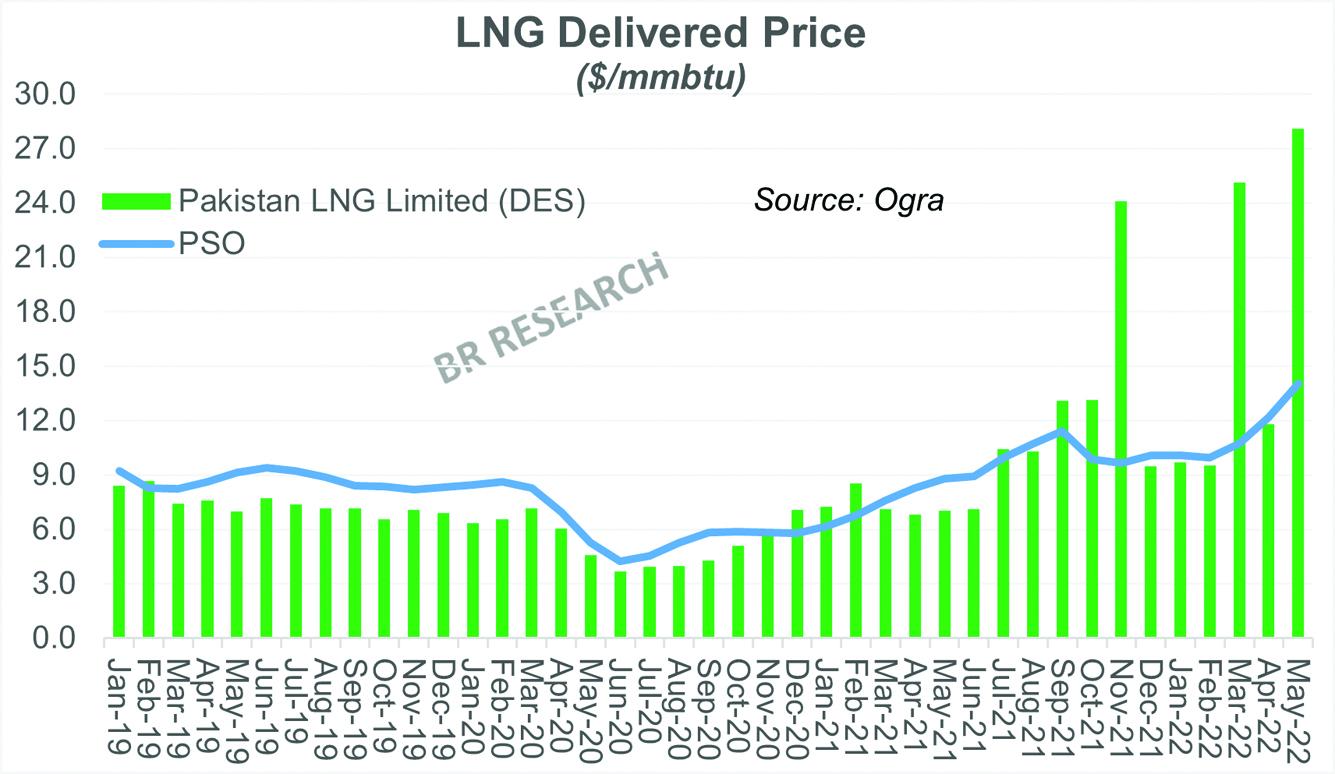

Here is why. Pakistan has reportedly decided to go ahead and procure LNG spot cargoes for May and June. For May 2022, three cargoes have been locked in at average Delivered Ex-Ship (DES) price of $28.12/mmbtu. Adding terminal charges, and other import costs at $1.5/mmbtu – this could mean an LNG monthly import bill of c.$350 million – easily the highest ever.

Assuming six cargoes from the long-term Qatar deal arrive at an average Brent price of $105/bbl for previous three months – the DES would come around $14/mmbtu and $15.5/mmbtu after accounting for import charges. That is another $300 million. Combined, the LNG import bill for May could well be in excess of $600 million for nine cargoes. This means LNG imports will surpass import of crude oil for the first time ever in the country’s history.

There is good reason for going ahead with LNG at all costs as summers approach. Water levels have struggled so far and with expected delay in rainfall, it could get trickier come end of May or beginning of June. Furnace oil is not getting any cheaper. Neither is coal. Any decline in availability of indigenous fuel sources will invariably be a big strain on import bill, and resultantly, electricity tariff.

The consumer price at distribution level excluding GST threatens to reach $23/mmbtu for May 2022 – beating the high of $17/mmbtu comfortably. A number of LNG plants may still sit lower on merit order of dispatch, given the prices involved. But the bigger and more efficient power plants could well run near full capacity, even at fuel cost nearing Rs20/unit.

The bigger challenge will be ensuring seamless transmission from the three big RLNG plants, when they are operating near full throttle. Often times in the past, the ailing transmission network has failed to evacuate power from the RLNG plants, despite availability. Here is hoping such high fuel cost does not go down the drain because of transmission constraints. All this while, it is worth mention that Pakistan is without an energy minister yet. It must not go on like this for any longer – for the challenges keep coming.

Comments

Comments are closed.