Observers in Pakistan have been fretting every single day tracking the global crude oil movement, with emotions ranging from deep despair to a ray of light. Tracking a commodity as volatile as crude oil is sure to give you volatile results. From touching $140/bbl a few days ago, oil has come down to $104/bbl. This now sounds low, but it was not long ago when everyone and their aunt were losing sleep over the prospects of oil at $100/bbl.

Much has been said and written about the merits or the lack thereof, of the government’s petroleum price relief package. Calculations have been thrown in day in and day out, predicting doomsday scenario based on cherrypicked numbers – fearing how Pakistan will soon run out of fiscal space in an effort to foot the bill.

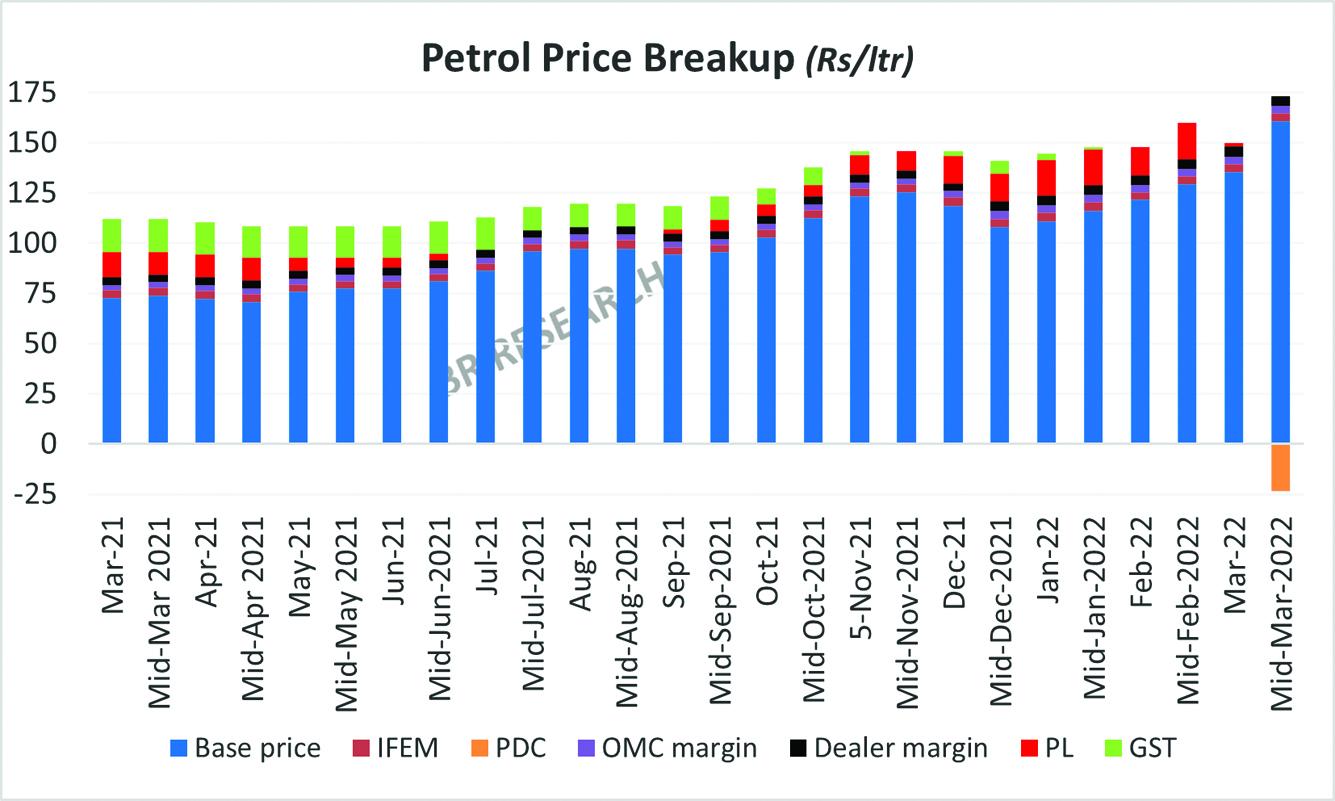

Recall that a substantial sum has been earmarked for keeping petroleum prices at the current level. When the decision to freeze prices was taken, Brent was trading around $98/bbl, which translates into $109/bbl for the reference Arab light crude for RON 95. The March second fortnight prices have resulted in a Petroleum Differential Claim of Rs23/ltr, which is very high by all accounts.

What must be kept in mind is that it is based on the multiyear high crude oil prices, when Russia-Ukraine tensions were peaking. The reference Arab Light crude price stood at $128/bbl, leading to an increase of Rs25/ltr in just the base price. That meant almost the entire differential was to be covered via PDC. For the ongoing fortnight, assuming constant demand of HSD and petrol, this should lead to a hole of Rs18-20 billion.

It goes without saying, that should oil prices remain where they were for the reference period from Feb26-Mar11, it will be catastrophic. But oil has retreated since. The new normal could still be around $100/bbl, which means the government could do without having to go the PDC route, and just continue to forgo the revenues, while still charging custom duty on imports. To cut it short, international crude oil price around $100/bbl will still be managed without having to take the PDC route.

Oil market dynamics are pretty much the same, with an addition of risk premium. The Opec group has not felt the need to pump more oil just yet, and even the slightest hint of demand drop from China tanked the prices from $130/bbl to $100/bbl, signaling the much-talked about equilibrium may well be true. All in all, if all hell does not break loose, the price freeze still looks manageable.

Comments

Comments are closed.