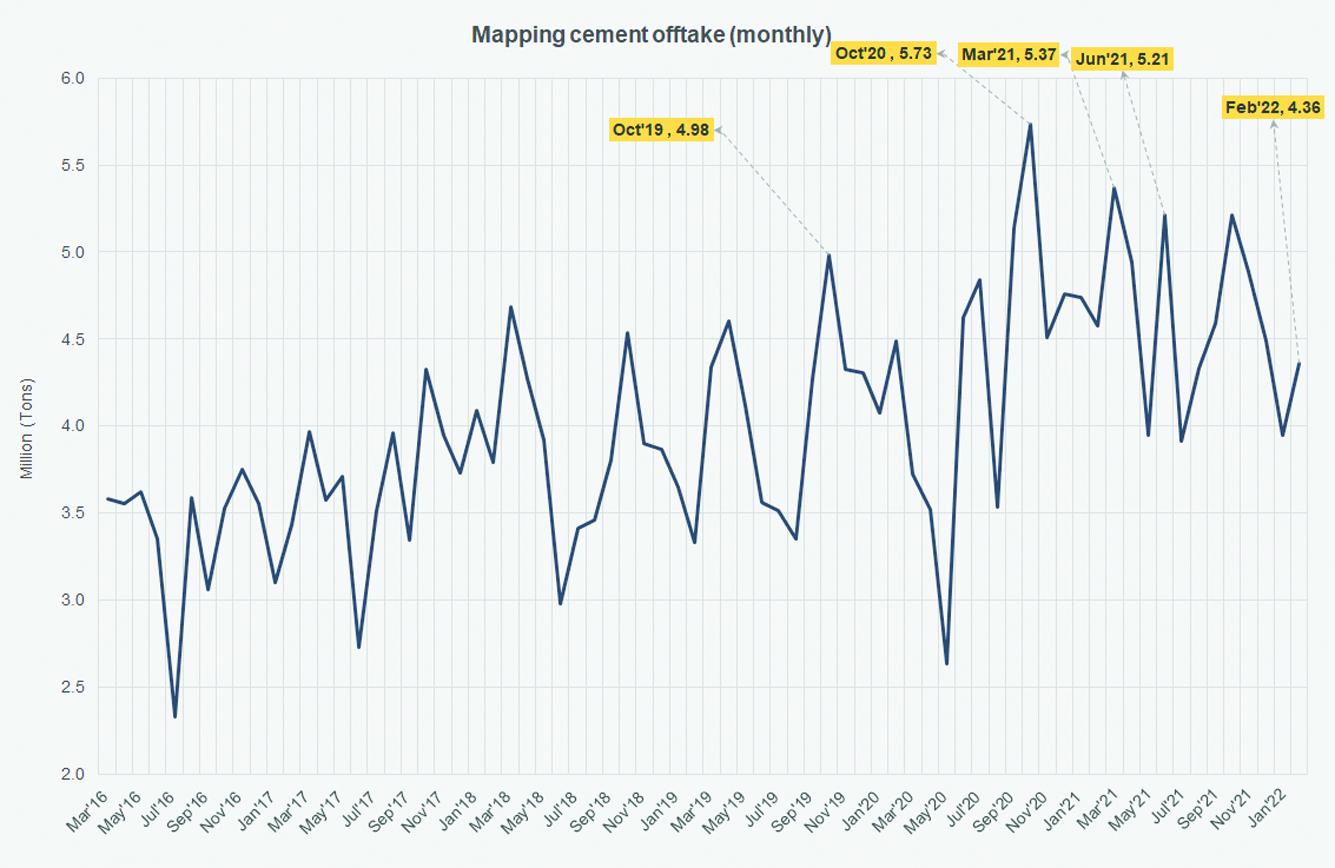

Rather expectedly, cement offtake is nowhere it was supposed to be when projections were being made last year. Calling cement dispatches unimpressive would be polite. Exports have certainly plummeted as freight costs have risen steeply over the past year making it unfeasible to sell abroad. At the same time, political upheaval in Afghanistan next door has also caused demand to plunge. For the latest month of Feb-22, exports stood at 9 percent of total cement dispatches, the lowest share since the covid-quarter. In 8MFY22, they are cumulatively 13 percent of sales—last year, this was 17 percent. In tons, exports have free- fallen by 31 percent versus the 1 percent decline in domestic offtake during this period. But the entire blame of suppressed demand cannot be shouldered by exports alone.

Since the announcement of the government’s construction amnesty scheme and the Naya Pakistan Housing Program (NPHP), there has been more voice than actual foot to the pedal construction work on the ground. Cement dispatches do not support the shared enthusiasm of the industry at large that new projects will take offtake at new heights (read more: “Construction and housing: Boom, doom or bust”, Dec 31, 2021). Average monthly sales year-to-date stand at 3.9 million tons, roughly the same as the average number last year (3.95 m tons). Growth is not visible.

In winter, there is always a seasonal slowdown on construction activity, but months prior have not offered much reason for celebration. Demand has remained subdued specially among private sector projects because of the rising cost of construction—where both cement and steel prices have climbed several times (cumulatively steel prices went up by 64% and cement by 16% between the Jul-Nov period) in turn due to the price hikes in inputs abroad. Coal and other fuels have experienced a massively volatile year with prices reaching new heights due to various demand and supply related challenges, a lot of which can be traced back to the disruption that covid left in its wake. Even with the virus being brought to a certain level of control, commodity prices cannot be tamed. Now with the fast-brewing Russia-Ukraine war, fuel prices are in frenzy once again, and coal is a ready victim.

Cement manufacturers were importing coal from Afghanistan, adding the less pricey fuel into their inventory but the price gap is now closing-in, which would jerk cement manufacturers back to the starting line. If they keep raising prices, demand would get affected. In 1HFY22, however, most cement manufacturers have raised earnings on the back of solid retention despite reduced demand. If that keeps making sense for their balance sheets, cement demand would remain subdued and prices will keep being raised. Slowly but surely, but no way can demand flourish given the current economic and political environment within and outside the country. Exports at 13 percent of offtake are the best the industry can manage at this point.

Public-sector planned projects such as dam construction and housing plans under NPHP supported by NAPHDA will absorb a big share of the demand while higher prices may keep many private sector housing plans away from the market, at least for a time being.

Comments

Comments are closed.