Power generation in November 2021 went up by 14 percent year-on-year. The same has gone by nearly 9 percent for Jul-Nov period year-on-year. These are good numbers, without being extraordinary. The suggestion from different quarters—that these numbers indicate a switch to electric heating from natural gas users in the wake of concessional winter package on incremental electricity consumption—is unfounded.

Recall that the government has also substantially curtailed natural gas supply to captive power producers, which should have led to more grid consumption from industrial users. While the step is good for the overall financial health of the power system, it must not be mistaken for organic demand growth of the same magnitude. What must also be kept in mind that power demand flattened and then dipped just before and during Covid. The growth should be viewed in that context.

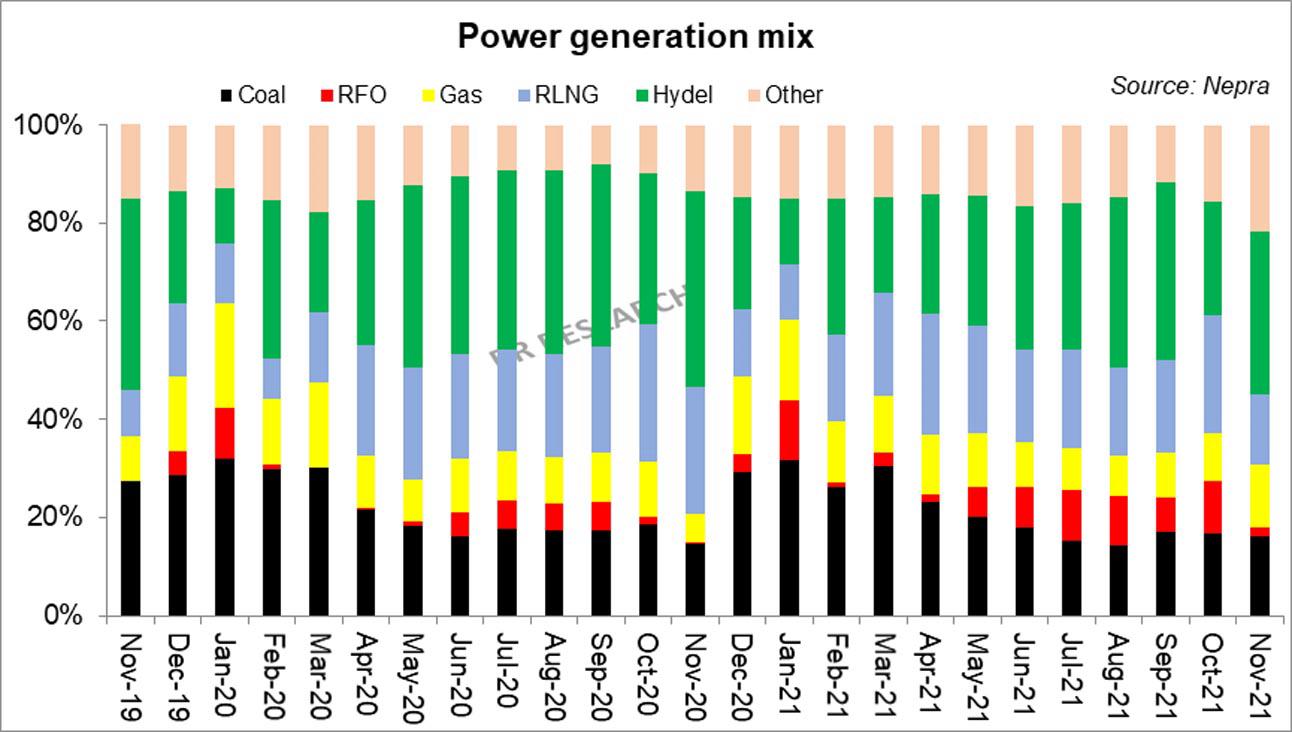

Now on to the more important part, that is the generation mix. Staring right at the face is furnace oil-based power generation which has more than doubled during the 5-month period to 5.6 billion units. The share in generation has shot up to 9 percent, lying to rest all previous claims of zero furnace oil-based power generation. The fuel bill for the same exceeds Rs105 billion, which is thrice as more year-on-year.

The authorities’ inability to timely arrange imported gas has at times caused FO based plants to be run ahead of order. At other times, it has been the inability to evacuate power form RLNG based plants that have necessitated FO based generation to maintain the base load. In some cases, FO based generation has followed the merit order, due to significantly pricier RLNG, especially in the last two months, where a number of RLNG based plants sat lower on merit order of dispatch than a few FO based plants.

The system constraints have laid bare the state of affairs in the energy chain, as the existing gas quota for power plants does not meet the demand. It has been officially stated that for RLNG based plants to receive adequate imported gas at all times, nothing less than a new terminal would do. It must be remembered that government carries its own set of priorities when it comes to natural gas supply, where domestic and fertilizer usage takes precedence over power sector.

Nuclear generation has been the savior, more than doubling in absolute terms and share. Without it, given limited LNG availability (that too at record high rates), depleting gas reserves, and lower hydel supply – furnace oil generation could have been even higher than it was.

The fuel bill for the second month running has skyrocketed to monthly high, requiring an upwards adjustment north of Rs 4.3 per unit. October monthly adjustment in lieu of FCA is just a month old, where consumers were hit with a record Rs4.75/unit. The average fuel cost for November 2021 is more than twice the revised reference tariff of Rs3.74/unit. The revised reference tariff is already up by 50 percent from the same period last year.

The remaining winter months could see more of the same in terms of generation mix.

There could be some respite in terms of monthly adjustments, but that would still remain north of Rs2/unit, even in the best-case scenario of crude oil not shooting up from current rates. While most of the fuel cost increase is unavoidable, some of it could surely have been dealt better with more focus on addressing technical constraints, and effective communication over fuel supply.

Comments

Comments are closed.